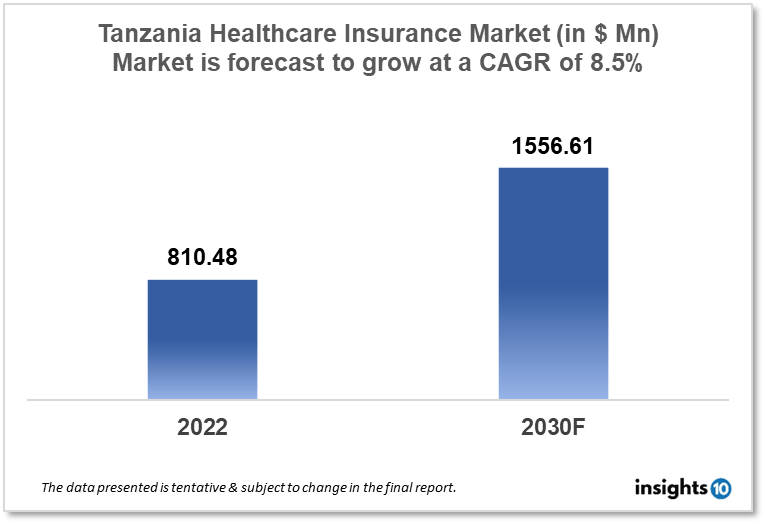

Tanzania Healthcare Insurance Market Analysis

The Tanzania healthcare insurance market is projected to grow from $810.48 Bn in 2022 to $1556.61 Bn by 2030, registering a CAGR of 8.5% during the forecast period of 2022 - 2030. The main factors driving the growth would be increasing population, technological advancements and government support. The market is segmented by component, the provider, coverage, by health insurance plans and end-user. Some of the major players include Bumaco, MyHI, Jubilee, Britam and AAR Insurance.

Buy Now

Tanzania Healthcare Insurance Market Executive Summary

The Tanzania healthcare insurance market is projected to grow from $810.48 Bn in 2022 to $1556.61 Bn by 2030, registering a CAGR of 8.5% during the forecast period of 2022 - 2030. In 2019, the national health expenditures of Tanzania represented 3.83% of GDP or $40 per person. Tanzania has high rates of pneumonia, malaria, HIV/AIDS, and maternal and neonatal mortality, as well as a poor healthcare system and few resources.

International donors that contribute up to 40% of the health budget supplement the financing of healthcare. The US government, through USAID and the Centers for Disease Control and Prevention (CDC), makes a large financial contribution to initiatives that support the Tanzanian government. To increase accessibility to high-quality healthcare services, there has been a drive to implement health insurance in Tanzania in recent years. In order to offer health insurance to workers in the formal sector and their families, Tanzania established the National Health Insurance Fund (NHIF) in 1999. However, health insurance coverage is low, with only 32% of Tanzanians having health insurance as of 2019. There are barely 1% of those people have private health insurance.

Market Dynamics

Market Growth Drivers

The Tanzania healthcare Insurance market is expected to be driven by factors such as:

- Increasing population- Tanzania's population is expanding rapidly which is expanding the market for health insurance. Tanzania's population grew from 10.05 Mn in 1960 to 63.59 Mn in 2021. This is an increase of 532.6 per cent over 61 years

- Technological advancements- The demand for health insurance in Tanzania is increasing as a result of technological developments in the healthcare sector, such as telemedicine, which are increasing access for people to healthcare. Since 2012, the Tanzanian government has viewed digitalization as essential to the development of the country's health sector because of its alleged capacity to enhance, among other things, the flow and accessibility of health information, the management of people and material resources, as well as decision-making processes at various levels

- Government initiatives- The Tanzanian government has supported initiatives to widen access to health insurance, which is helping the growth of the healthcare insurance market in the region. In 2020–2021, the government of Tanzania allocated $387.9 Mn for the health sector, of which $155.5 Mn will be used on development projects to aid in the implementation of the initiatives aimed at enhancing the public

Market Restraints

The following factors are expected to limit the growth of the healthcare insurance market in Tanzania:

- Low levels of income- Many Tanzanians are facing challenges in making the ends meet due to their low level of income which makes it hard for them to spend on healthcare insurance. As healthcare services are so expensive in Tanzania, particularly for specialised treatments, health insurance premiums are quite high. Around 52% of all healthcare costs in Tanzania are paid for out of pocket by individuals which represents the majority of Tanzanians

- Limited awareness- In Tanzania, although more people are becoming aware of health insurance options, many still lack awareness and understanding about how insurance works or are only aware of the benefits of insurance. The insurance penetration in the country is low as people's opinions of both public and private health care are unfavourable. They are perceived as being high-priced, remote, of poor quality, and offering inadequate continuity of care

Competitive Landscape

Key Players

- Bumaco (TZA)- About 30 years have passed since Bumaco Insurance first entered the market. It provides a range of business, family, health, and life insurance products. Its cheaper premiums are one of its noteworthy characteristics. To ensure that claims are processed quickly and easily, they have a far more streamlined claims process

- MyHI (My Health Insurance) (TZA)- It is a insurtech startup based in Dar-es-Salaam. It aims to simplify and streamline all aspects of getting access to health insurance services, including policy purchases, client interactions, and policy renewals. The MyHI platform eliminates all the paperwork and the lost time associated with traditional health insurance

- Jubilee- With the liberalisation of the financial sector in 1998, The Jubilee Insurance Company of Tanzania Limited is the first private insurance business to be founded in Tanzania. Its insurance plans include J-care, J-seniors, and J-care juniors

- Britam- A prominent and well-diversified financial organisation, Britam has business interests not just in Tanzania but also in Eastern and Southern Africa. It provides health insurance that will pay for maternity, chronic and acute diseases, radiology pathology burial costs, and benefits for accidental death as well as high hospital bills of up to $85,470.

- AAR Insurance- AAR Insurance, a top provider of health insurance in Tanzania, offers a range of services, including medical, dental, and vision coverage

Healthcare Policies and Regulatory Landscape

The Tanzanian healthcare insurance market is overseen by the National Health Insurance Fund (NHIF) and the Tanzania Insurance Regulatory Authority (TIRA). The Tanzanian insurance market, particularly the market for health insurance, is under the governance and authority of TIRA. It is in charge of granting insurance businesses licences and making sure they abide by the legal requirements. The NHIF also has the power to accept or reject applications for various healthcare insurance products.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Healthcare Insurance Market Segmentation

By Provider (Revenue, USD Billion):

It mainly includes healthcare insurance that provides safety against the increasing cost of medical treatments and in case of health emergencies such as critical illnesses. Hence, it is the best way to safeguard medical expenses.

- Public

- Private

By Coverage Type (Revenue, USD Billion):

In terms of sales and market share, it is anticipated to rule the market over the projection period. This is explained by a number of benefits provided by life insurance, including guaranteed death payout and permanent coverage. Additionally, investing in these kinds of plans enables working professionals to save taxes

- Life Insurance

- Term Insurance

By Health Insurance Plans (Revenue, USD Billion):

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High Deductible Health Plan (HDHP)

By Demographics (Revenue, USD Billion):

- Minors

- Adults

- Seniors

There is a high prevalence of lifestyle disease in the adult population that can increase health risks in the future. The population is more prone to cardiac and other diseases that require hospitalization. Healthcare insurance plans for seniors are more of a necessity, especially in the case of retirement. Also, it carries various advantages such as no medical screening before buying plans, includes coverage of the outpatient department, and provides the benefit of fee annual checkups along with lifetime renewability.

By End-user (Revenue, USD Billion):

- Individuals

- ?Corporates

A large number of people buy individual health plans as they are also customizable. Also, it gives more control over deductibles, co-pays, and benefits limits and is not dependent on employment status.

Insights10 will provide you with the reports within 10 key parameters which are:

- Market Overview

- Market Growth Drivers & Restraints

- Epidemiology of Disease Type

- Market Segmentation

- Market Share

- Competitive Landscape

- Key Company Profiles

- Healthcare Policies & Regulatory Framework

- Reimbursement Scenario

- Factors Driving Future Growth

Based on our many years of experience, we believe that these are the parameters that are critical to decision-making for business stakeholders. Our focused approach to developing reports focused on 10 key parameters, enabled us to arrive at the name “Insights10”.

Stage I: Market Data Collection

Primary Interviews: We have developed a network of experts, freelancers, and researchers across countries through which we engage with local experts to gather key data points and assumptions about each market. We also engage regularly with some of the best market research agencies such as Atheneum, GuidePoint, GLG, etc. to conduct surveys and interviews, and build intelligence. We have language translators as a part of our team, who between them can cover 30+ languages allowing us to extract better local insights.

Secondary Data Collection: We have developed strong expertise and experience in secondary data collection methods for developing unique data sets and research material. We gather data from multiple reliable sources to maintain a high level of accuracy and consistency. The market data is analyzed and forecasted using appropriate statistical and coherent models. The report offers an overall analysis of the market size, growth, and market share as well as a segment-level analysis of the specific market. Our report includes precise, to-the-point information related to the overall market, competition, growth drivers, challenges, regulatory updates, and competition.

Data Sources: We have access to multiple highly reliable free and subscription data sources. We have many years of experience to understand which sources are more dependable for what and which to prefer for the reliable and latest information. The key sources of information include the following, but are not limited to:

Stage II: Market Data Analysis and Statistical Model

Market Trends: We generally look at macro parameters and micro indicators. The macro parameters include changes in government policies, demand and supply of the market, government intervention programs, and major market share. The micro indicators are GDP growth, market size, market volume, etc. We also understand nuances specific to each country like the US, Canada, India, Germany, etc., and have worked across 60+ countries and hence not only understand global trends but how these differ by country, how payment models, market structure, cultural parameters, etc. differ in each country.

Market Sizing and Analysis: Our expert data analytics team has created various market forecast models by employing the top-down approach i.e. starting with the large overall market and segmenting different areas and the bottom-up approach i.e. starting with population and epidemiology and rolling up based on spend, etc., estimating the size of the market, and distributing among the geographic and/or product segments.

The top-down approach is mainly used for new product forecasting and the bottom-up approach is used for demand estimation of any product for different countries summed up to form the total market. We are able to round off insights and build stronger forecasts because we always do both these methods and triangulate the final numbers.

The study on the market covers the analysis of the leading geographies such as Asia-Pacific, Africa, Europe, Middle East, North America, and Latin America for the period of 2022 to 2030. The qualitative analysis covers the industry landscape and trends, market opportunities, competitive landscape, and policy and regulatory scenario, and the quantitative analysis covers different market estimates and forecasts.

Data Triangulation & Validation:

Data triangulation of various sources and results of the research are carried out by benchmarking with reliable sources such as industry statistics, statistical databases, and company-level averages, etc.

We make sure to finalize the numbers in alignment with the market research. Firstly, our internal experts ensure thorough validation and checking to ensure accurate and precise analysis and then validation is also done using a multiple-data analysis model. Two-level validation is done and entails the finalization of the report scope and the way of representation pattern.

(1).png)

Stage III: Interpretation and Presentation

Analysis & Interpretation: The information gathered is then analyzed and synthesized. The second series of interviews are done if necessary to check and validate. The future opportunities are analyzed by understanding product commercialization and many other factors. It also comprises the analysis of data discrepancies observed across various data sources. Information procured from secondary and primary results is then, interpreted by considering the following parameters: (a partial list)

- Establishing market drivers and trends

- Analyzing the regulatory landscape to understand future growth

- Market Segment based analysis to obtain revenue/volume

- Analyzing current needs and determining penetration to estimate the market

Insights: Our reports deliver actionable insights backed with supporting facts and figures to assist you in achieving exemplary growth. Our in-depth analyses are interspersed with relevant insights and statistics to offer an executive-level view of a given market. The description helps in correlating many minor factors affecting the market and their impact on the different segments within the market.

Data curated from the analysis and interpretation are drawn to portray all in one consolidated report.

Presentation & Reporting: The market research report is presented in different forms such as charts by using a scientific approach for easy understanding. Historic, current, and future analysis is provided for each market in terms of both value and volume. The size of the market is interpreted in the US Dollar value and the respective unit, based on the product, for volume consumption.

The foreign exchange rates are calculated on the respective dates and for the respective regions covered in the study.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

This report addresses

- Intelligent insights to take informed business decisions

- Qualitative, acute and result oriented market analysis

- Market size and forecasts from 2022 to 2030

- Opportunities for expansion and in-depth market analysis

- Segmentation and regional revenue forecasts

- Analysis of the market share and competitive landscape

- Strategic Recommendations to chart future course of action

- Comprehensive Market Research Report in PDF and PPT formats

Need more?

- Ask our analyst how this study was put together to learn more

- Discuss additional requirements as part of the free customisation

- Add more countries or regions to the scope

- Get answers to specific business questions

- Develop the business case to launch the product

- Find out how this report may influence your business revenue