Robotics - A New Era in Surgical Innovation

Large incisions have been used by surgeons for generations to perform surgery, introduce the required surgical equipment, and get a complete view of the organ they needed to treat. The new era of robotic surgery has come into the limelight in the last two decades.

Buy Now Download Sample Report

Robotic or automated surgery enables medical professionals to carry out a variety of difficult procedures with greater control, precision, and adaptability than is feasible with conventional methods. Mechanical surgery is frequently related to minimally invasive procedures that are carried out through tiny incisions.

The robotic surgery market is going to reach $12 Billion by 2030, growing at a CAGR of 19.3% during the forecasted period 2022-2030

Key Insights

- Robotic or automated surgery, allows doctors to perform numerous types of complex procedures with more precision, adaptability, and control than is possible with traditional techniques. Mechanical surgery is usually associated with negligibly invasive surgery - procedures performed through small incisions

- Since certain operations, such as radical prostatectomy and partial nephrectomy, lend themselves to the complexities of robotic technology, urology has historically been the primary driver of robotics in the UK

- These procedures have become highly efficient with excellent outcomes, so future gains from improving surgical robotics are likely to be had outside of this field in areas such as ear, nose, and throat (ENT) and thoracic surgery alongside gynecology and general surgery

- Improvements in commercial viability and accessibility will encourage the translation of the present robotic surgical systems into a considerably larger range of procedures. Robotic utilization in these areas is currently growing quickly

- Manufacturers and software developers are using 3D imaging to create Augmented Reality (AR) solutions that can optimize surgical procedures and training tools

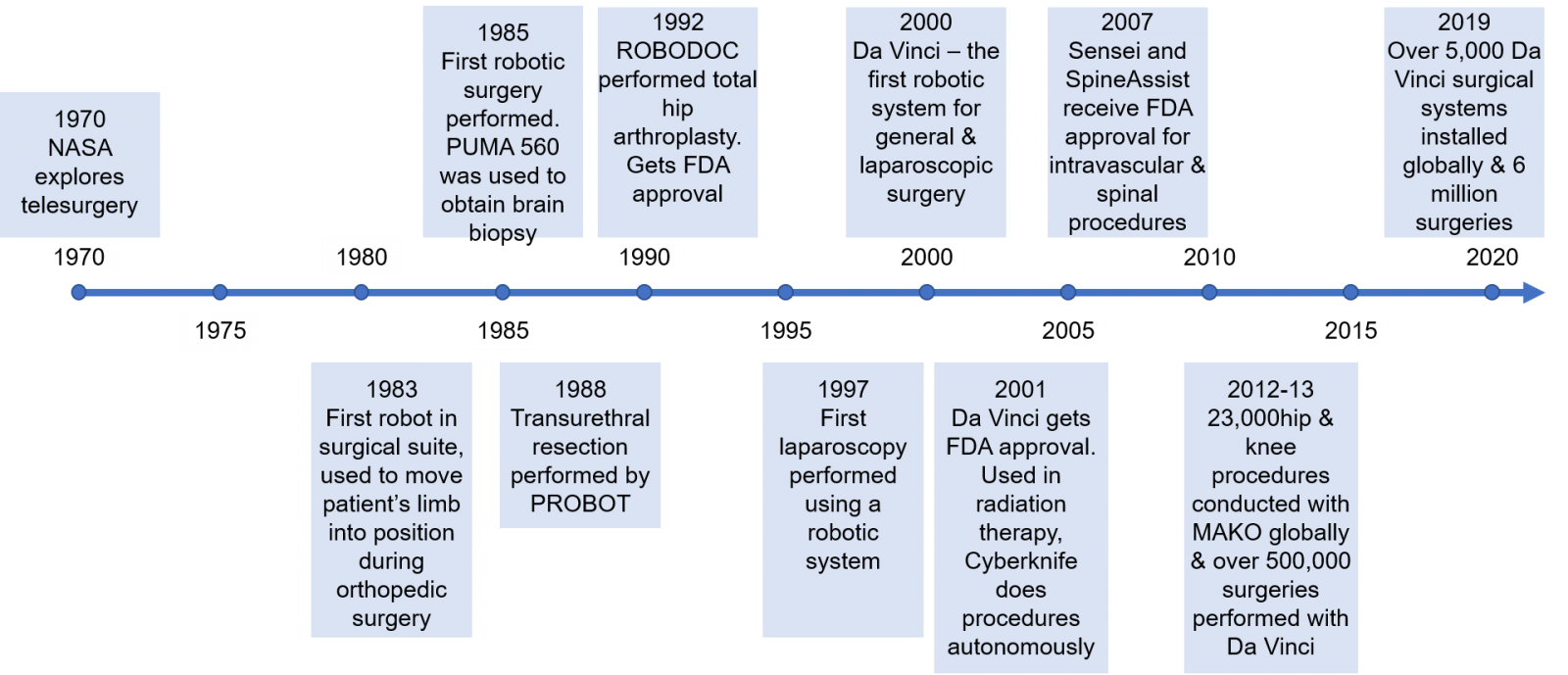

Robotics in Surgery: The Journey from Past to Present

Robotics in Surgery: Future Trends

Novel Surgical Platforms

Novel surgical platforms and technology ownership models will continue to be introduced. New healthcare technologies are often developed and introduced in response to tight hospital budgets. The infusion and widespread adoption of new medical solutions are dependent on the availability of reasonably priced enabling technologies and new business models.

Surgical Robots in ASCs

Robotics-assisted technology can support the high-volume, low-cost procedures that are typically performed with ambulatory surgery centers (ASCs). Robotics-assisted technology offers low operating costs through the use of standard reusable instruments and open-platform architecture that allows hospitals to leverage existing technology investments.

Telehealth/Telesurgery

The future of telesurgery relies on two factors – the availability of 5G and the widespread adoption of robotics-assisted technologies. As 5G becomes more prevalent, coupled with advances in robotics-assisted technologies, telesurgery will become an increasingly viable option for certain procedures

Novel Surgical Platforms

CMR Surgical - Versius

- Versius consists of separate single-arm carts and an open console; wristed instrument tips also provide seven degrees of freedom

- Arms of Versius are lightweight and provide ease of transport and deployment

- The Versatility of Versius, with the ability to add and remove arm carts, makes it a more practical portable solution

- Already been installed in hospitals in Germany, Australia, and the UK as of June 2021

Johnson & Johnson - Ottava

- Recently announced its surgical robot platform, Ottava

- will consist of six robotic arms integrated into the operating table; the design provides a zero-footprint device that frees up space and enables better patient access

- J&J is also expanding into orthopedics with VELYS, their table-mounted robotic system aimed at increasing the accuracy of bony cuts, recently receiving FDA approval

Medtronic - Hugo

- Recently performed the first patient procedure, a radical prostatectomy, using their contribution

- Hugo's robotic-assisted surgery system possesses similar qualities to CMR's Versius, with its modular, open-console design

- Compatibility with the globally-trusted Medtronic surgical instrumentation may make Hugo a more accessible and successful competitor

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Insights10 will provide you with the reports within 10 key parameters which are:

- Market Overview

- Market Growth Drivers & Restraints

- Epidemiology of Disease Type

- Market Segmentation

- Market Share

- Competitive Landscape

- Key Company Profiles

- Healthcare Policies & Regulatory Framework

- Reimbursement Scenario

- Factors Driving Future Growth

Based on our many years of experience, we believe that these are the parameters that are critical to decision-making for business stakeholders. Our focused approach to developing reports focused on 10 key parameters, enabled us to arrive at the name “Insights10”.

Stage I: Market Data Collection

Primary Interviews: We have developed a network of experts, freelancers, and researchers across countries through which we engage with local experts to gather key data points and assumptions about each market. We also engage regularly with some of the best market research agencies such as Atheneum, GuidePoint, GLG, etc. to conduct surveys and interviews, and build intelligence. We have language translators as a part of our team, who between them can cover 30+ languages allowing us to extract better local insights.

Secondary Data Collection: We have developed strong expertise and experience in secondary data collection methods for developing unique data sets and research material. We gather data from multiple reliable sources to maintain a high level of accuracy and consistency. The market data is analyzed and forecasted using appropriate statistical and coherent models. The report offers an overall analysis of the market size, growth, and market share as well as a segment-level analysis of the specific market. Our report includes precise, to-the-point information related to the overall market, competition, growth drivers, challenges, regulatory updates, and competition.

Data Sources: We have access to multiple highly reliable free and subscription data sources. We have many years of experience to understand which sources are more dependable for what and which to prefer for the reliable and latest information. The key sources of information include the following, but are not limited to:

Stage II: Market Data Analysis and Statistical Model

Market Trends: We generally look at macro parameters and micro indicators. The macro parameters include changes in government policies, demand and supply of the market, government intervention programs, and major market share. The micro indicators are GDP growth, market size, market volume, etc. We also understand nuances specific to each country like the US, Canada, India, Germany, etc., and have worked across 60+ countries and hence not only understand global trends but how these differ by country, how payment models, market structure, cultural parameters, etc. differ in each country.

Market Sizing and Analysis: Our expert data analytics team has created various market forecast models by employing the top-down approach i.e. starting with the large overall market and segmenting different areas and the bottom-up approach i.e. starting with population and epidemiology and rolling up based on spend, etc., estimating the size of the market, and distributing among the geographic and/or product segments.

The top-down approach is mainly used for new product forecasting and the bottom-up approach is used for demand estimation of any product for different countries summed up to form the total market. We are able to round off insights and build stronger forecasts because we always do both these methods and triangulate the final numbers.

The study on the market covers the analysis of the leading geographies such as Asia-Pacific, Africa, Europe, Middle East, North America, and Latin America for the period of 2022 to 2030. The qualitative analysis covers the industry landscape and trends, market opportunities, competitive landscape, and policy and regulatory scenario, and the quantitative analysis covers different market estimates and forecasts.

Data Triangulation & Validation:

Data triangulation of various sources and results of the research are carried out by benchmarking with reliable sources such as industry statistics, statistical databases, and company-level averages, etc.

We make sure to finalize the numbers in alignment with the market research. Firstly, our internal experts ensure thorough validation and checking to ensure accurate and precise analysis and then validation is also done using a multiple-data analysis model. Two-level validation is done and entails the finalization of the report scope and the way of representation pattern.

(1).png)

Stage III: Interpretation and Presentation

Analysis & Interpretation: The information gathered is then analyzed and synthesized. The second series of interviews are done if necessary to check and validate. The future opportunities are analyzed by understanding product commercialization and many other factors. It also comprises the analysis of data discrepancies observed across various data sources. Information procured from secondary and primary results is then, interpreted by considering the following parameters: (a partial list)

- Establishing market drivers and trends

- Analyzing the regulatory landscape to understand future growth

- Market Segment based analysis to obtain revenue/volume

- Analyzing current needs and determining penetration to estimate the market

Insights: Our reports deliver actionable insights backed with supporting facts and figures to assist you in achieving exemplary growth. Our in-depth analyses are interspersed with relevant insights and statistics to offer an executive-level view of a given market. The description helps in correlating many minor factors affecting the market and their impact on the different segments within the market.

Data curated from the analysis and interpretation are drawn to portray all in one consolidated report.

Presentation & Reporting: The market research report is presented in different forms such as charts by using a scientific approach for easy understanding. Historic, current, and future analysis is provided for each market in terms of both value and volume. The size of the market is interpreted in the US Dollar value and the respective unit, based on the product, for volume consumption.

The foreign exchange rates are calculated on the respective dates and for the respective regions covered in the study.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

This report addresses

- Intelligent insights to take informed business decisions

- Qualitative, acute and result oriented market analysis

- Market size and forecasts from 2022 to 2030

- Opportunities for expansion and in-depth market analysis

- Segmentation and regional revenue forecasts

- Analysis of the market share and competitive landscape

- Strategic Recommendations to chart future course of action

- Comprehensive Market Research Report in PDF and PPT formats

Need more?

- Ask our analyst how this study was put together to learn more

- Discuss additional requirements as part of the free customisation

- Add more countries or regions to the scope

- Get answers to specific business questions

- Develop the business case to launch the product

- Find out how this report may influence your business revenue