Philippines Anti Aging Therapeutics Market Analysis

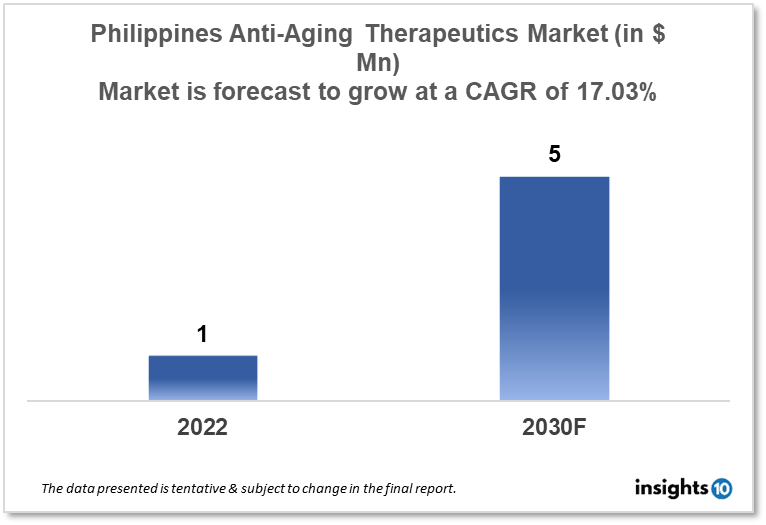

Philippines anti-aging therapeutics market is projected to grow from $1 Mn in 2022 to $5 Mn in 2030 with a CAGR of 17.03% for the year 2022-2030. The increase in disposable incomes and more investments in the R&D projects for anti-aging drugs in Philippines are the major growth drivers of the market. The Philippines anti-aging therapeutics market is segmented by product, treatment, target group, type of aging, type of molecules, mechanism of action, ingredient, and by distribution channel. Distriphil, PHIX Genomics, and Rejuvenate Bio are among the top players in the market.

Buy Now

Philippines Anti-Aging Therapeutics Market Executive Summary

The Philippines anti-aging therapeutics market size is at around $1 Mn in 2022 and is projected to reach $5 Mn in 2030, exhibiting a CAGR of 17.03% during the forecast period. Allocations made in the $96 Bn national budget for 2023 will aid in defending the Philippine economy from the "negative" effects of both internal and external shocks. It has been noted that the primary beneficiaries of the Philippine government's investment in healthcare will be generic drug manufacturers. Officials claim that social workers can, with permission from the field office, finance medications for as little as $100 and as much as $500. This supports our prediction that healthcare spending in the Philippines will increase consistently through 2026, from $15 Bn in 2016 to $36 Bn.

Rich Filipinos are paying between $12,500 and $18,000 per session for stem cell therapy in the belief that it will improve their general health and make them look younger in a nation where many elites are obsessed with anti-aging. In China, India, and many other Asian nations, stem cell therapy is popular for both medical and cosmetic uses. Laws and implementation, however, have not generally kept up with medical advancements, much like in the Philippines. In the midst of a chaotic and frequently dubious boom in the industry, the Philippine Department of Health is frantically trying to control local stem cell therapy practices. Stem cells (SCs) have changed the conventional idea of anti-ging and gained more attention as a new treatment approach as a result of the ongoing development of biotechnology. The Standardization Guide of Stem Cell Antiaging Technology refers to sources of human autograft or allograft SCs that are cultured in vitro and then given locally through injection into particular areas of the human body or intravenously.

Market Dynamics

Market Growth Drivers Analysis

More Filipinos can now afford anti-aging goods and services thanks to the country's expanding economy and increasing income levels. The desire for anti-aging therapeutics, including both pharmaceutical and non-pharmaceutical products, has increased as a result of this. Filipinos are becoming more and more conscious of the advantages of anti-aging treatments. As a result, there is now a higher demand for and readiness to spend money on anti-aging goods and services. The Philippine government has put in place a number of measures to support the growth of the anti-aging industry and encourage healthy aging. These include financial commitments to R&D, tax breaks for business owners operating in the sector, and collaborations with foreign organizations.

Market Restraints

Not all Filipinos can afford the many costly anti-aging treatments available. This may reduce consumer desire, especially those with lower incomes, for these goods and services. Some Filipinos might consider aging to be a normal part of life and may not see the need to spend money on anti-aging procedures. This may reduce demand, especially among older groups, for these goods and services. Alternative or conventional therapies may be preferred by some Filipinos over anti-aging medications. This might discourage people from purchasing these goods and services, especially those who take a more traditional or conservative strategy to healthcare.

Competitive Landscape

Key Players

- Biotech Systems (PHL)

- Amylex Biotechnology (PHL)

- Gano iTouch (PHL)

- Distriphil (PHL)

- PHIX Genomics (PHL)

- Rejuvenate Bio

- Rejenevie Therapeutics

- MyMD Pharmaceuticals

- Intervene Immune

- CohBar

Healthcare Policies and Regulatory Landscape

The Food and Drug Administration (FDA) is the regulatory agency in charge of approving and regulating medications in the Philippines, including anti-aging medications. All medications sold in the Philippines must be secure, efficient, and of excellent quality, according to the FDA. This entails examining and authorizing applications for fresh medications as well as keeping an eye on the efficacy and security of already available medications. A company in the Philippines must send an application to the FDA with details on the drug's safety, effectiveness, and manufacturing procedures in order to get FDA approval for a new anti-aging drug. The FDA then examines the application and may need more data or research before deciding whether to approve it. After a drug is authorized, the FDA continues to oversee its quality and safety through manufacturing facility checks and post-marketing surveillance. If there are any safety or quality concerns, the FDA may also take regulatory action, such as recalling a drug or rescinding its clearance. The Philippine National Police and the Department of Health are two additional regulatory organizations in the Philippines that might have a say in regulating anti-aging medications in addition to the FDA. These groups could be engaged in enforcing drug laws, controlling the sale and distribution of drugs, and looking into nefarious drug activity.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Anti-Aging Therapeutics Market Segmentation

By Product (Revenue, USD Billion):

- Anti-Wrinkle

- Hair Color

- Ultraviolet (UV) Absorption

- Anti-Stretch Mark

- Others

By Treatment (Revenue, USD Billion):

- Hair Restoration

- Anti-Pigmentation

- Adult Acne Therapy

- Breast Augmentation

- Liposuction

- Chemical Peel

- Others

By Target Group (Revenue, USD Billion):

- Male

- Female

By Type of Aging (Revenue, USD Billion):

- Cellular Aging

- Immune Aging

- Metabolic Aging

- Others

By Type of Molecules (Revenue, USD Billion):

- Biologics

- Small Molecules

By Mechanism of Action (Revenue, USD Billion):

- Senolytic

- Cell Regeneration

- mTOR inhibitor/Modulator

- AMP-kinase/AMP Activator

- Mitochondria Inhibitor/Modulator

- Others

By Ingredient (Revenue, USD Billion):

- Retinoid

- Hyaluronic Acid

- Alpha Hydroxy Acid

- Others

By Distribution Channel (Revenue, USD Billion):

- Pharmacies

- Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.