Mexico Allergy Therapeutics Market Analysis

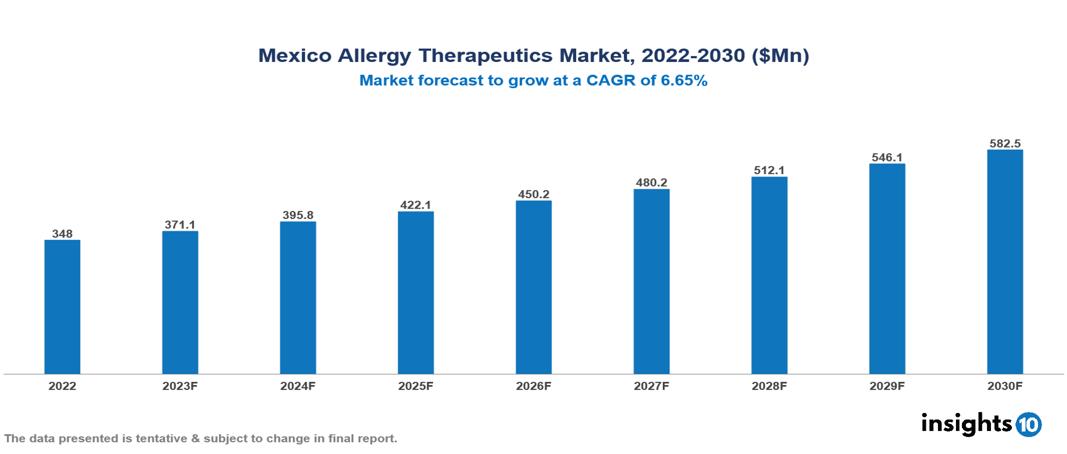

Mexico Allergy Therapeutics Market was valued at $348 Mn in 2022 and is estimated to reach $582 Mn in 2030, exhibiting a CAGR of 6.65% during the forecast period. The market for allergy treatment medications is expanding as a result of the rising incidence of allergic illnesses and associated health problems. The top leading pharmaceutical companies operating in the market are GlaxoSmithKline, Sanofi, Merck & Co., Novartis, Bayer, Johnson & Johnson, Teva Pharmaceutical Industries, Valeant Pharmaceuticals International, Grupo farmacéutico Sanfer and Genomma Laboratorios.

Buy Now

Mexico Allergy Therapeutics Market Executive Summary

Mexico Allergy Therapeutics Market was valued at $348 Mn in 2022 and is estimated to reach $582 Mn in 2030, exhibiting a CAGR of 6.65% during the forecast period.

Allergens are harmless substances found in the environment that trigger an immunological reaction. Dust mites, pollen, mold, and commonly consumed food triggers such as milk, eggs, soy, and almonds are common origins of these allergies. These allergies can cause a variety of symptoms, from minor ones like a runny nose and itchy eyes to serious ones like anaphylaxis, which can cause breathing difficulties and even cause a person to lose consciousness. Immunotherapy, avoiding allergens, and using prescription drugs such as antihistamines and nasal corticosteroids are some methods for treating allergies.

The incidence of allergies is a significant health issue in Mexico, where 10%–15% of the population suffers from an allergy of some kind. Among them, allergic rhinitis is the most common, affecting around 10%–15% of people and resulting in symptoms including congestion, itchy eyes, a runny nose, and sneezing that greatly impair quality of life. A further worry is food allergies, which impact 2%–5% of adults and 8%–10% of children. Common allergens include seafood, eggs, cow's milk, peanuts, and almonds. Severe reactions to these allergies frequently call for emergency medical intervention. An estimated 5%–10% of people have skin allergies, with eczema accounting for the majority of cases. Other common skin allergies include hives, contact dermatitis, and medication allergies. Moreover, 8% of Mexicans suffer from respiratory allergies, which include asthma. Mold, dust mites, and pollen are among the triggers that can cause an asthma attack.

A major research project at Mexico's National Institute of Public Health (INSP) is investigating the complex interactions between genetic and environmental factors that lead to the emergence of food allergies in young Mexicans. Finding high-risk populations and possible preventive measures are the main objectives.

Tec de Monterrey is at the forefront of cutting-edge research with the development of oral immunotherapy (OIT) pills that are intended to treat allergies to peanuts. The goal of this research is to provide a more practical and easily available substitute for current peanut allergy therapies.

Market Dynamics

Market Growth Drivers

Rising Prevalence of Allergies: An estimated 10-15% of Mexicans are estimated to be affected by allergies, including food, skin, and respiratory conditions. The prevalence of allergies is thought to be rising, especially in youngsters. The market is expanding due to this increased demand.

Increased Awareness and Diagnosis: More access to healthcare, public health campaigns, and educational programs result in earlier and more accurate allergy diagnoses, which encourage people to seek treatment.

Development of New and Improved Therapies: Technological innovations that provide more effective and customized treatment, such as sublingual immunotherapy (SLIT), targeted monoclonal antibodies for particular illnesses, and personalized medication alternatives, are driving the market.

Market Restraints

Cultural and Behavioural Factors: Market penetration may be hampered by certain groups preference for home remedies or traditional medications over modern therapies. Communities with lower levels of knowledge may take longer to identify and comprehend allergy symptoms, which could result in delayed diagnosis and treatment initiation.

High Cost of Treatment: Due to their high cost, many modern, effective allergy treatments, including biologics and sublingual immunotherapy, are out of reach for a considerable section of the population. This cost barrier may prevent patients from receiving the best care possible and prevent these medicines from being widely used in the market.

Treatment Compliance and Adherence: Consistent commitment to long-term regimens is crucial for the efficacy of allergy treatments, especially immunotherapy therapies. Obstacles including exorbitant expenses, complexity, or unfavourable outcomes resulting in insufficient patient compliance possess the capacity to reduce therapy effectiveness and hinder the market's growth.

Notable Recent Updates:

- August 2022, the FDA has approved Thermo Fisher Scientific's ImmunoCAP blood tests for detecting allergies to wheat and sesame. The company claims that by identifying particular antibodies, in vitro diagnostic tests may distinguish between grass cross-reactivity and wheat sensitization and assist a great number of patients in avoiding needless dietary restrictions.

Healthcare Policies and Regulatory Landscape

Multiple institutions oversee the regulatory control of allergy treatment medications in Mexico, as well as healthcare policy. As the principal regulatory body, the Federal Commission for the Protection against Health Risk COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios), is in charge of approving, registering, and supervising drugs after they are sold. Accessibility and distribution of medications used to treat allergies are influenced by healthcare policy defined by the Secretariat of Health. In order to support evidence-based treatment plans, the National Institute of Public Health (INSP) carries out research, including investigations on the genetic and environmental variables causing food allergies. The Comisión Nacional de Bioética (CONBIOÉTICA) oversees ethics, especially in clinical studies. Healthcare organizations that influence access and reimbursement rules include the Mexican Social Security Institute (IMSS), and the Patent Office (IMPI) safeguards intellectual property, which includes patents for novel allergy treatment medications.

Competitive Landscape

Key Players

- GlaxoSmithKline

- Sanofi

- Merck & Co.

- Novartis

- Bayer

- Johnson & Johnson

- Teva Pharmaceutical Industries

- Valeant Pharmaceuticals International

- Grupo farmacéutico Sanfer

- Genomma Laboratorios.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Mexico Allergy Therapeutics Market Segmentation

By Treatment Type

- Anti-allergy drugs

- Immunotherapy

By Type of Allergy

- Eye allergy

- Asthma

- Skin allergy

- Food allergies

- Rhinitis

- Other allergy types

By Route of Administration

- Oral

- Inhalers

- Intranasal

- Other routes of administration

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Other distribution channel

Insights10 will provide you with the reports within 10 key parameters which are:

- Market Overview

- Market Growth Drivers & Restraints

- Epidemiology of Disease Type

- Market Segmentation

- Market Share

- Competitive Landscape

- Key Company Profiles

- Healthcare Policies & Regulatory Framework

- Reimbursement Scenario

- Factors Driving Future Growth

Based on our many years of experience, we believe that these are the parameters that are critical to decision-making for business stakeholders. Our focused approach to developing reports focused on 10 key parameters, enabled us to arrive at the name “Insights10”.

Stage I: Market Data Collection

Primary Interviews: We have developed a network of experts, freelancers, and researchers across countries through which we engage with local experts to gather key data points and assumptions about each market. We also engage regularly with some of the best market research agencies such as Atheneum, GuidePoint, GLG, etc. to conduct surveys and interviews, and build intelligence. We have language translators as a part of our team, who between them can cover 30+ languages allowing us to extract better local insights.

Secondary Data Collection: We have developed strong expertise and experience in secondary data collection methods for developing unique data sets and research material. We gather data from multiple reliable sources to maintain a high level of accuracy and consistency. The market data is analyzed and forecasted using appropriate statistical and coherent models. The report offers an overall analysis of the market size, growth, and market share as well as a segment-level analysis of the specific market. Our report includes precise, to-the-point information related to the overall market, competition, growth drivers, challenges, regulatory updates, and competition.

Data Sources: We have access to multiple highly reliable free and subscription data sources. We have many years of experience to understand which sources are more dependable for what and which to prefer for the reliable and latest information. The key sources of information include the following, but are not limited to:

Stage II: Market Data Analysis and Statistical Model

Market Trends: We generally look at macro parameters and micro indicators. The macro parameters include changes in government policies, demand and supply of the market, government intervention programs, and major market share. The micro indicators are GDP growth, market size, market volume, etc. We also understand nuances specific to each country like the US, Canada, India, Germany, etc., and have worked across 60+ countries and hence not only understand global trends but how these differ by country, how payment models, market structure, cultural parameters, etc. differ in each country.

Market Sizing and Analysis: Our expert data analytics team has created various market forecast models by employing the top-down approach i.e. starting with the large overall market and segmenting different areas and the bottom-up approach i.e. starting with population and epidemiology and rolling up based on spend, etc., estimating the size of the market, and distributing among the geographic and/or product segments.

The top-down approach is mainly used for new product forecasting and the bottom-up approach is used for demand estimation of any product for different countries summed up to form the total market. We are able to round off insights and build stronger forecasts because we always do both these methods and triangulate the final numbers.

The study on the market covers the analysis of the leading geographies such as Asia-Pacific, Africa, Europe, Middle East, North America, and Latin America for the period of 2022 to 2030. The qualitative analysis covers the industry landscape and trends, market opportunities, competitive landscape, and policy and regulatory scenario, and the quantitative analysis covers different market estimates and forecasts.

Data Triangulation & Validation:

Data triangulation of various sources and results of the research are carried out by benchmarking with reliable sources such as industry statistics, statistical databases, and company-level averages, etc.

We make sure to finalize the numbers in alignment with the market research. Firstly, our internal experts ensure thorough validation and checking to ensure accurate and precise analysis and then validation is also done using a multiple-data analysis model. Two-level validation is done and entails the finalization of the report scope and the way of representation pattern.

(1).png)

Stage III: Interpretation and Presentation

Analysis & Interpretation: The information gathered is then analyzed and synthesized. The second series of interviews are done if necessary to check and validate. The future opportunities are analyzed by understanding product commercialization and many other factors. It also comprises the analysis of data discrepancies observed across various data sources. Information procured from secondary and primary results is then, interpreted by considering the following parameters: (a partial list)

- Establishing market drivers and trends

- Analyzing the regulatory landscape to understand future growth

- Market Segment based analysis to obtain revenue/volume

- Analyzing current needs and determining penetration to estimate the market

Insights: Our reports deliver actionable insights backed with supporting facts and figures to assist you in achieving exemplary growth. Our in-depth analyses are interspersed with relevant insights and statistics to offer an executive-level view of a given market. The description helps in correlating many minor factors affecting the market and their impact on the different segments within the market.

Data curated from the analysis and interpretation are drawn to portray all in one consolidated report.

Presentation & Reporting: The market research report is presented in different forms such as charts by using a scientific approach for easy understanding. Historic, current, and future analysis is provided for each market in terms of both value and volume. The size of the market is interpreted in the US Dollar value and the respective unit, based on the product, for volume consumption.

The foreign exchange rates are calculated on the respective dates and for the respective regions covered in the study.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

This report addresses

- Intelligent insights to take informed business decisions

- Qualitative, acute and result oriented market analysis

- Market size and forecasts from 2022 to 2030

- Opportunities for expansion and in-depth market analysis

- Segmentation and regional revenue forecasts

- Analysis of the market share and competitive landscape

- Strategic Recommendations to chart future course of action

- Comprehensive Market Research Report in PDF and PPT formats

Need more?

- Ask our analyst how this study was put together to learn more

- Discuss additional requirements as part of the free customisation

- Add more countries or regions to the scope

- Get answers to specific business questions

- Develop the business case to launch the product

- Find out how this report may influence your business revenue