Malaysia ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Analysis

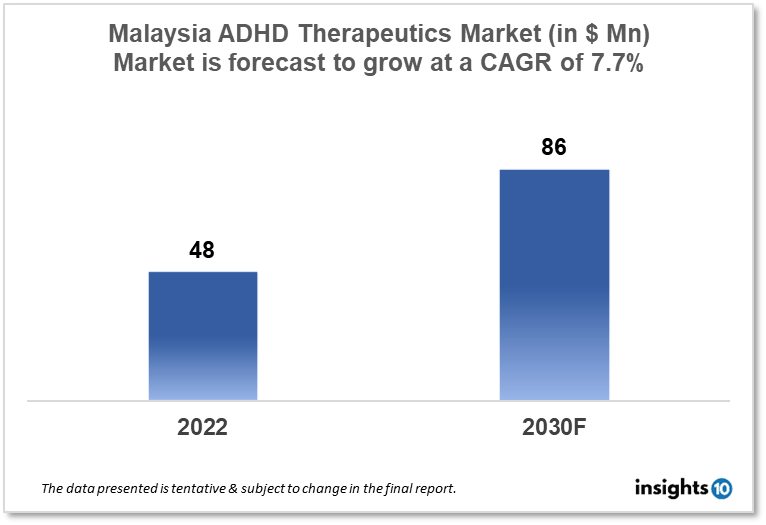

Malaysia's Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market is projected to grow from $48 Mn in 2022 to $86 Mn in 2030 with a CAGR of 7.7% for the year 2022-30. The rise in the prevalence of ADHD cases in Malaysia and the demand for novel treatment options are responsible for the growth of the market. The Malaysia ADHD therapeutics market is segmented by drug, drug type, demographics, and by distribution channel. Royce Pharma, GoodScience, and Eli Lilly are some of the key players in the market.

Buy Now

Malaysia Attention Deficit Hyperactivity Disorder (ADHD) Therapeutics Market Executive Analysis

The Malaysia Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market size is at around $48 Mn in 2022 and is projected to reach $86 Mn in 2030, exhibiting a CAGR of 7.7% during the forecast period. The Health Ministry of Malaysia would receive an allotment of $8.11 Bn, according to Prime Minister Datuk Seri Anwar Ibrahim, who presented the revised Budget 2023. This amount is slightly higher than the $8.07 Bn allocated under the spending plan put forth by the previous administration in October 2017 and the $7.24 Bn given under Budget 2022, making it the second-highest allocation under Budget 2023. 1,500 medical officers, dentists, and pharmacists will be hired for permanent and contract jobs with the help of $0.67 Bn in funding. Tax relief for medical expenses will rise from $1787.31 to $2234.34 for the year of assessment 2023.

High levels of impulsivity, hyperactivity, and inattention since early infancy are hallmarks of attention deficit hyperactivity disorder (ADHD). The officially reported prevalence rate of ADHD in Malaysia is 3.9%, but experts believe there may be more unreported instances than that. Boys (8–10%) have a greater incidence rate than girls (4%) in the community, and diagnoses are made before the age of 12. Stimulants like methylphenidate and amphetamine, non-stimulants like atomoxetine, tricyclic antidepressants, and alpha agonists are among the drugs that are frequently used for treating the symptoms of ADHD in Malaysia. Tics are another condition that is treated with alpha agonists. Treatment of ADHD is frequently given higher precedence than the medical management of tics because of how ADHD symptoms affect the child with a tic disorder.

Market Dynamics

Market Growth Drivers

There is a rising need for efficient treatments as both the general public and healthcare professionals become more conscious of ADHD. The demand for medication and therapy is rising as more individuals seek an ADHD diagnosis and treatment. The rising prevalence of ADHD and the greater understanding of its symptoms are driving up demand for Malaysia's ADHD therapeutics market. There is an increase in sales of ADHD medications because many patients are searching for efficient treatments to control their symptoms.

Market Restraints

In Malaysia, there is still a stigma attached to mental health issues, which deters some from seeking therapy for ADHD. This could slow the Malaysia ADHD therapeutics market's expansion by lowering the demand for ADHD treatments and medicines. For some patients, the cost of ADHD medications and therapies can be an impediment to treatment, especially for those with limited financial resources. A decrease in demand for ADHD treatments may restrain the Malaysia ADHD therapeutics market development.

Competitive Landscape

Key Players

- Hoe Pharmaceuticals (MYS)

- Noripharma (MYS)

- Prime Pharmaceutical (MYS)

- Royce Pharma (MYS)

- GoodScience (MYS)

- Eli Lilly

- Perdue Pharma

- Johnson and Johnson

- Janssen Pharmaceuticals, Inc.

- Takeda

- GlaxoSmithKline

Healthcare Policies and Regulatory Landscape

An organization under the Malaysian Ministry of Health, the National Pharmaceutical Regulatory Division (NPRA), oversees registering pharmaceutical products, and traditional health supplements, and notifying consumers of cosmetic products that are sold in Malaysia. The NPRA is in charge of guaranteeing that Malaysian consumers receive high-quality, reliable treatments. The Malaysian market is also regulated to guarantee that natural (traditional) and cosmetic products are safe and of high quality. The NPRA health product registration search application was developed in accordance with the Pharmaceutical Services Program Strategic Plan, which placed strong stress on the use of cutting-edge technology to guarantee that customers are given accurate pharmaceutical information. In keeping with the 2018 National Regulatory Conference's theme, Regulatory Excellence; The New Normal, NPRA has started an initiative to strengthen regulations and better performance. In order to accomplish its goal to protect public health through scientific excellence in the regulation of medicines and cosmetics and to realize its vision to become a globally renowned regulatory agency, the agency is evaluating its systems and processes as part of this program.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Malaysia ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Segmentation

By Drug Type (Revenue, USD Billion):

- Stimulants

- Amphetamine

- Methylphenidate

- Dextroamphetamine

- Dexmethylphenidate

- Lisdexamfetamine

- Others

- Non-Stimulants

- Atomoxetine

- Bupropion

- Guanfacine

- Clonidine

By Age Group (Revenue, USD Billion):

- Pediatric And Adolescent

- Adult

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Speciality Clinics

- Retail Pharmacies

- e-Commerce

By Psychotherapy (Revenue, USD Billion):

- Behaviour Therapy

- Cognitive Behavioral Therapy

- Interpersonal Psychotherapy

- Family Therapy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.