Global Bioinformatics Market Analysis

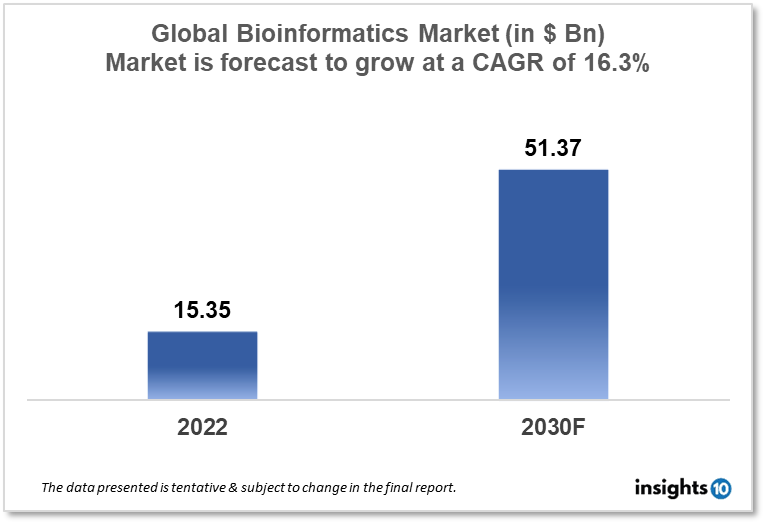

The Global Bioinformatics market is projected to grow from $15.35 Bn in 2022 to $51.37 Bn by 2030, registering a CAGR of 16.30% during the forecast period of 2022 - 2030. The main factors driving the growth would be the demand for integrated data, more protein and nucleic acid sequencing due to lower sequencing costs, and increased proteomics and genomics applications. The market is segmented by technology and by application. Some of the major players include Thermo Fisher Scientific, Qiagen, IBM Life Sciences, Agilent Technologies, Illumina, and PerkinElmer.

Buy Now

Global Bioinformatics Market Executive Summary

The Global Bioinformatics market is projected to grow from $15.35 Bn in 2022 to $51.37 Bn by 2030, registering a CAGR of 16.30% during the forecast period of 2022 - 2030. In 2021, national healthcare spending in the world as a percentage of GDP reached 9.83% achieving $1,115.01 per capita.

The study of bioinformatics merges biology and information technology. Data generation, data warehousing, data mining, data management, and other approaches are used in bioinformatics. In order to provide statistical frameworks and data processing methods for applications like next-generation sequencing, modeling of genomic and proteomic structure, and three-dimensional drug discovery, bioinformatics software, and tools are used as integrated solutions.

The Global bioinformatics market was dominated by North America in 2019, accounting for the largest share, and it is projected that this trend will continue during the forecast period. This is attributable to the rapid uptake of cutting-edge technology and the rise in demand for improved bioinformatics tools, both of which are essential to the process of discovering and developing new drugs. The market in LAMEA is anticipated to expand at the highest CAGR during the forecast period as a result of advances in the fields of genomics and proteomics, which are producing vast amounts of data that must be evaluated and handled.

Market Dynamics

Market Growth Drivers

The demand for integrated data, more protein and nucleic acid sequencing due to lower sequencing costs, and increased proteomics and genomics applications are all projected to contribute to the worldwide bioinformatics market's rapid growth in the coming years. During the projection period, activities from both public and private organizations and drug discovery and development are also expected to boost market expansion.

Government entities and significant market participants in both emerging and developed countries are heavily investing in information technology projects. Additionally, market participants are engaged in research and development efforts in planning for the introduction of new items to the marketplace. So, increasing R&D activities will also support the growth of the global bioinformatics industry.

Market Restraints

The adoption of new and cutting-edge technologies and technical advancements are enabling the growth of the global bioinformatics industry. In the bioinformatics market, the market participants are significantly implementing next-generation sequencing technologies. The database is produced and kept up to date with the aid of this technology. Here, data is essential for the bioinformatics market's expansion. As a result, the global market for bioinformatics is being constrained by growing concerns about data privacy and security. Moreover, a lack of skilled staff, standard data formats, and an absence of affordable, user-friendly technologies are anticipated to restrain market expansion during the projection period.

Competitive Landscape

Key Players

- Thermo Fisher Scientific

- Qiagen

- IBM Life Sciences

- Agilent Technologies

- Illumina

- PerkinElmer

Notable Recent Deals

January 2023: QIAGEN acquired Verogen to strengthen the company's position as a leader in the field of human identification and forensics, which is backed by process automation, genetic testing analysis, and sample preparation. This deal expands on cooperation established in 2021 to supply Verogen's NGS-based panels, GEDmatch bioinformatics products, and Illumina MiSeq FGx sequencer.

September 2020: Illumina partnered with Roche and a software suite to accelerate the use of genomics as well as new sequencing devices. According to the terms of the arrangement, Illumina will provide Roche the right to create and market IVD tests for both its upcoming NovaSeqDx diagnostic sequencing system and Illumina's NextSeqTM 550Dx System. Illumina's comprehensive pan-cancer test, TruSight Oncology 500, will be improved with additional Companion Diagnostic (CDx) claims thanks to a partnership between Roche and Illumina (TSO 500).

Healthcare Policies and Regulatory Landscape

The US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the Japanese Pharmaceuticals and Medical Devices Agency (PMDA) are some of the government agencies that oversee the global bioinformatics business. These organizations are in charge of policing the creation, endorsement, and promotion of bioinformatics goods and services. Privacy rules, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in the European Union, govern the use and storage of sensitive Personal Health Information (PHI). Intellectual property rules, such as patents, copyrights, and trademarks, which defend businesses' rights to use and promote their bioinformatics goods and services, also have an effect on the worldwide bioinformatics market.

Reimbursement Scenario

Depending on the nation and region, several reimbursement practices are used in the worldwide bioinformatics market. Public health insurance systems may be used to pay for bioinformatics goods and services in various nations. These programs' degree and scope of payment can change depending on the nation and the particular good or service being reimbursed. Bioinformatics products and services may also be covered by private health insurance plans, albeit the amount of coverage offered by these plans can vary greatly depending on the policy and the insurance provider. Additionally, in some nations, there can be government financing schemes or grants access to support the creation and application of bioinformatics goods and services.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Bioinformatics Market Segmentation

By Technology (Revenue, USD Billion):

- Knowledge Management Tools

- Bioinformatics Platforms

- Bioinformatics Services

By Application (Revenue, USD Billion):

- Metabolomics

- Molecular phylogenetics

- Transcriptomics

- Chemoinformatic & drug design

- Genomics

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.