Tanzania Anti Aging Therapeutics Market Analysis

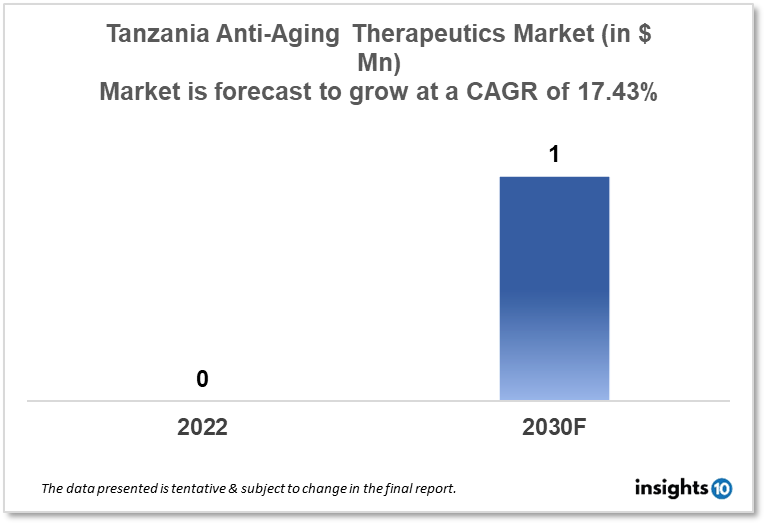

Tanzania anti-aging therapeutics market is projected to witness growth from $0 Mn in 2022 to $1 Mn in 2030 with a CAGR of 17.43% for the year 2022-2030. The rise in the aging population in Tanzania and the supportive regulatory initiatives taken by the Tanzanian government are the major market drivers for the growth of the market. The Tanzania anti-aging therapeutics market is segmented by product, treatment, target group, type of aging, type of molecules, mechanism of action, ingredient, and by distribution channel. Nashukuru Pharma, Arwa Pharmacy, and Intervene Immune are the key players in the market.

Buy Now

Tanzania Anti-Aging Therapeutics Market Executive Summary

The Tanzania anti-aging therapeutics market size is at around $0 Mn in 2022 and is projected to reach $1 Mn in 2030, exhibiting a CAGR of 17.43% during the forecast period. Tanzania continues to invest far less on health care than is advised by the World Health Organization (WHO). Tanzania is moving closer to achieving universal healthcare; in 2020–21, $387.9 Mn was allocated by the government for the health sector, of which $155.5 Mn will be used for programs that will help the government carry out its plans to improve public health. In 2022/23, the industry will receive $480 Mn. International donors who give up to 40% of the health budget supplement the financing of healthcare. Through USAID and CDC, the US government makes a sizable contribution to initiatives that help the Tanzanian government. Only 32% of Tanzanians had health insurance as of 2019; this indicates the country's poor level of health insurance coverage. Only 1% of those people have private health insurance.

Examining existing medications that could combat aging is one area of study that is being done in Tanzania. The fact that these drugs have already been routinely used in clinical settings on people and that Bns of pounds have already been spent testing their safety and effectiveness makes this approach advantageous. Originally created as an immunosuppressant, rapamycin has been revealed that it can increase mice's lifespans by about 15% when consumed in small doses. This is followed by a number of aging-related changes that are slowing down, including tendon stiffening and liver and heart deterioration. By blocking the protein mTOR, which controls how much protein is produced by cells, rapamycin delays the aging process. By inhibiting it, broken proteins can be recycled by cells rather than being allowed to accumulate.

Metformin is the second potential drug. Researchers discovered after decades of use that patients taking it had lower rates of death and illness than those who did not. Metformin appears to function by reducing the inflammation set on by senescent cells, according to data from a variety of studies carried out in cells, animals, and people. Furthermore, metformin helps mitochondrial function and protein recycling. The ability of a cell to produce energy and engage in regular respiration depends on this. Due to this, the medication is intended to be a leading contender in clinical trials.

Market Dynamics

Market Growth Drivers Analysis

Tanzania's populace is aging, like that of many other nations. The demand for anti-aging therapeutics rises as a result of people becoming more prone to age-related illnesses and health conditions as they age. The Tanzanian population is becoming increasingly aware of the health benefits of anti-aging treatments. The demand for these goods will rise as more people become aware of these advantages. Efforts have been made by the Tanzanian administration to advance healthcare and well-being there. These programs include encouraging the use of anti-aging medications and fostering a supportive regulatory climate for the expansion of Tanzania anti-aging therapeutics market.

Market Restraints

Tanzania has a sizable population, but there is little recourse to medical care. This restricts the population that can use anti-aging treatments and could impede the Tanzania anti-aging therapeutics market's expansion. Some people cannot afford the high cost of anti-aging therapies. This restricts the market to those who can purchase the goods, potentially slowing the market's expansion. For the production of more cutting-edge and potent anti-aging products, more funding for research and development is required. This is crucial for the market's long-term expansion.

Competitive Landscape

Key Players

- Tridem Pharma (TZA)

- Tanga Pharmaceuticals (TZA)

- Inqaba Biotec (TZA)

- Nashukuru Pharma (TZA)

- Arwa Pharmacy (TZA)

- Intervene Immune

- Khondrian

- Longeveron

- LyGenesis

- Mesoblast

- Minovia Therapeutics

- Mitobridge

- Navitor Pharmaceuticals

- NeuroTrack

- Nuchido

Healthcare Policies and Regulatory Landscape

The Tanzania Food and Drugs Authority (TFDA) is Tanzania's drug and medical product regulatory authority. Tanzanian food, drug, and medical equipment quality, safety, and efficacy are governed and controlled by the TFDA, a government organization. The organization is also in charge of licensing and filing pharmaceuticals and medical equipment for use in the nation. Although the TFDA is not specifically focused on anti-aging medications, all medications and healthcare products, including therapeutics for anti-aging, must be registered and licensed by the TFDA in order to be distributed in Tanzania. All medications and medical products must abide by the rules and laws established by the TFDA in order to guarantee their efficacy, safety, and high quality. To oversee the Tanzanian healthcare sector, the TFDA collaborates closely with other governmental organizations like the Ministry of Health, Community Development, Gender, Elderly, and Children. To make sure that its regulations are in line with international best practices, the agency also works with other international regulatory bodies and groups.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Anti-Aging Therapeutics Market Segmentation

By Product (Revenue, USD Billion):

- Anti-Wrinkle

- Hair Color

- Ultraviolet (UV) Absorption

- Anti-Stretch Mark

- Others

By Treatment (Revenue, USD Billion):

- Hair Restoration

- Anti-Pigmentation

- Adult Acne Therapy

- Breast Augmentation

- Liposuction

- Chemical Peel

- Others

By Target Group (Revenue, USD Billion):

- Male

- Female

By Type of Aging (Revenue, USD Billion):

- Cellular Aging

- Immune Aging

- Metabolic Aging

- Others

By Type of Molecules (Revenue, USD Billion):

- Biologics

- Small Molecules

By Mechanism of Action (Revenue, USD Billion):

- Senolytic

- Cell Regeneration

- mTOR inhibitor/Modulator

- AMP-kinase/AMP Activator

- Mitochondria Inhibitor/Modulator

- Others

By Ingredient (Revenue, USD Billion):

- Retinoid

- Hyaluronic Acid

- Alpha Hydroxy Acid

- Others

By Distribution Channel (Revenue, USD Billion):

- Pharmacies

- Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.