Spain Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Analysis

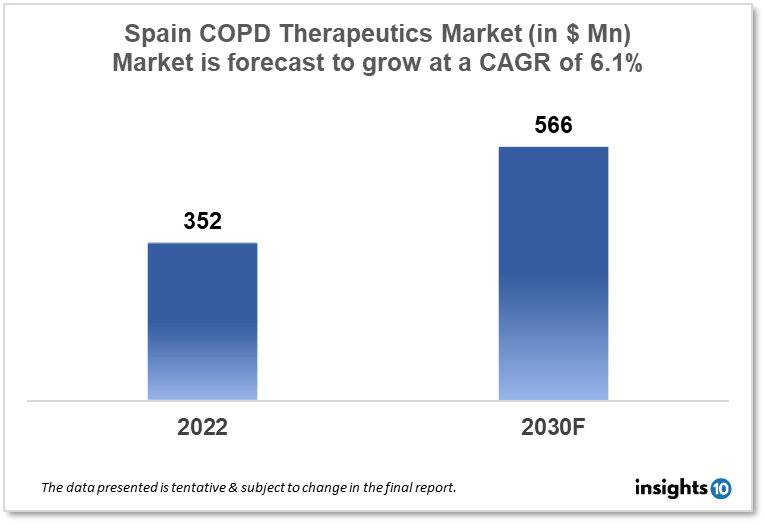

Spain's Chronic Obstructive Pulmonary Disease (COPD) therapeutics market was valued at $352 Mn in 2022 and is estimated to expand at a CAGR of 6.1% from 2022 to 2030 and will reach $566 Mn in 2030. One of the main reasons propelling the growth of this market is the ageing population and government initiatives. The market is segmented by drug class and by distribution channel. Some key players in this market are Bioiberica, Ferrer, Laboratorios Esteve, Chiesi España, Almirall, Astellas Pharma, AstraZeneca, Boehringer Ingelheim Pharmaceuticals, Novartis, Pfizer, Teva Spain Limited and others.

Buy Now

Spain Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Executive Summary

The Spain Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market was valued at $352 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 6.1% from 2022 to 2030 and will reach $566 Mn in 2030. Airflow restriction and partial irreversibility are hallmarks of the potentially preventable chronic respiratory condition known as chronic obstructive pulmonary disease (COPD). By 2030, COPD is expected to overtake all other causes of death to become the third-leading cause of death globally. Not just in low-income nations, but also in high-income nations with a rising older population, is COPD more prevalent. The prevalence of COPD is anticipated to increase by 29% in Spain by 2030 as a result of the country's changing demographics. The primary risk factor for COPD is cigarette smoking, which is followed by indoor and outdoor air pollution, workplace dangers, and respiratory infections.

Market Dynamics

Market Growth Drivers

COPD is a chronic disease that is becoming increasingly prevalent in Spain, mainly due to smoking and environmental pollution. According to a report by the Spanish Society of Pulmonology and Thoracic Surgery, around 10% of the Spanish population suffers from COPD, and this figure is expected to rise in the coming years. This increasing prevalence is a significant growth driver for the COPD therapeutics market in Spain. The elderly population in Spain is increasing, and this demographic is more susceptible to COPD. Around 20% of the Spanish population was aged 65 or older, and this percentage is expected to increase in the coming years.

As the elderly population increases, the demand for COPD therapeutics is also expected to rise, driving the market growth. With advancements in medical technology, more effective and efficient COPD therapeutics are being developed. For example, inhalers with digital sensors are now available, which can help patients manage their COPD better by tracking medication use and providing feedback on inhaler technique. These technological advancements are expected to increase the demand for COPD therapeutics and drive market growth. The Spanish government has implemented several initiatives to improve the management and treatment of COPD. For example, the government launched a national plan for COPD in 2018, which aims to improve the prevention, diagnosis, and treatment of the disease. These initiatives are expected to increase awareness of COPD and drive market growth.

Market Restraints

The market is highly competitive, with several established players and new entrants vying for market share. This competition can make it challenging for companies to differentiate themselves and maintain their market position. COPD treatment can be costly, especially for patients who require frequent hospitalizations and medication. The high cost of treatment can be a barrier for some patients to access necessary therapies, which can affect market growth. Some COPD medications can have side effects, such as headaches, dizziness, and nausea, which can reduce patient compliance and satisfaction with treatment. This can affect the demand for COPD therapeutics in the market. Although there are several treatment options available for COPD, they do not cure the disease and can only provide symptom relief. This limited efficacy can be a challenge for patients and physicians, leading to a demand for more effective therapies. Companies operating in the COPD therapeutics market in Spain must adhere to regulatory requirements and guidelines. Compliance with these regulations can be time-consuming and costly, which can affect market growth.

Competitive Landscape

Key Players

- Bioiberica

- Ferrer

- Laboratorios Esteve

- Chiesi España

- Almirall

- Astellas Pharma

- AstraZeneca

- Boehringer Ingelheim Pharmaceuticals

- Novartis

- Pfizer

Healthcare Policies and Regulatory Landscape

Spain has a national healthcare system, which is funded through taxes and provides universal coverage to all citizens and legal residents. The healthcare system in Spain is decentralized, with responsibility for healthcare management shared between the central government and the regional governments. National Plan for COPD 2018, the Spanish government launched a national plan for COPD, which aims to improve the prevention, diagnosis, and treatment of the disease. The plan includes measures to increase awareness of COPD, improve early detection, and optimize treatment options. The Spanish government regulates the prices of pharmaceuticals to ensure that they are affordable and accessible to all citizens. This regulation can affect the pricing of COPD therapeutics in the market. Spain has a health technology assessment (HTA) system in place, which evaluates the effectiveness and cost-effectiveness of new technologies, including pharmaceuticals. HTA can influence the reimbursement and adoption of COPD therapeutics in the market.

Reimbursement Scenario

The Spanish government regulates the reimbursement system for pharmaceuticals. Pharmaceutical companies must apply for reimbursement for their products, and the government evaluates the products' safety, efficacy, and cost-effectiveness before deciding on the level of reimbursement. The level of reimbursement for COPD therapeutics in Spain varies, but generally, it ranges from 30% to 100% of the cost. The reimbursement rate can depend on the type of medication, the patient's medical history, and the region. As mentioned earlier, healthcare management is decentralized in Spain, and the regional governments have some autonomy in healthcare policy. Therefore, the reimbursement system can vary between regions, with some regions offering more generous reimbursement policies than others. Overall, the reimbursement scenario for COPD therapeutics in Spain is generally favorable, with most treatments reimbursed.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Spain Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Segmentation

By Drug Class

Bronchodilators: Bronchodilators are medications that help to relax the muscles around the airways, making it easier to breathe. These can be further classified as short-acting or long-acting bronchodilators.

Corticosteroids: Corticosteroids are anti-inflammatory medications that can help reduce swelling and inflammation in the airways. These can be used alone or in combination with bronchodilators.

Combination therapies: Combination therapies combine bronchodilators and corticosteroids in a single medication. These are often used for patients with more severe COPD.

Phosphodiesterase-4 inhibitors: Phosphodiesterase-4 inhibitors are medications that help to reduce inflammation and improve airflow in the lungs.

Others: Other medications that may be used to treat COPD include mucolytics, oxygen therapy, and vaccines for influenza and pneumococcal disease.

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.