South Africa Castrate Resistant Prostate Cancer Therapeutics Market Analysis

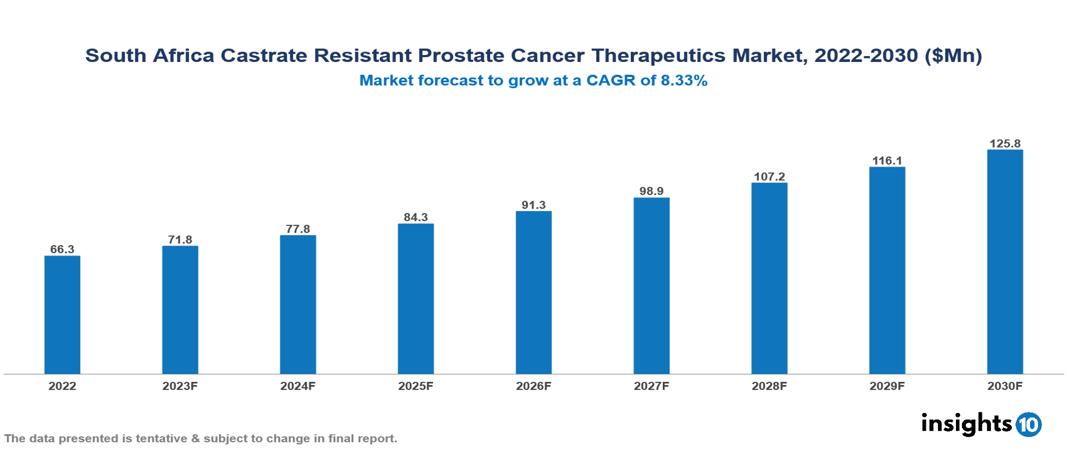

South Africa Castrate Resistant Prostate Cancer Therapeutics Market valued at $66 Mn in 2022, projected to reach $126 Mn by 2030 with a 8.33% CAGR. The key drivers of the market in South Africa include the increasing prevalence of prostate cancer, limited affordability and healthcare access creating an opportunity for generic drug manufacturers, and the combined effects of heightened awareness, improved diagnostics, and expanded treatment availability driving early detection and long-term management demand. The South Africa Castrate Resistant Prostate Cancer Therapeutics Market encompasses various players across different segments, including Pfizer, Johnson & Johnson, Roche, Bayer, AstraZeneca, Sanofi, Aspen, Novartis, Cipla, Dr Reddy’s, etc, among various others.

Buy Now

South Africa Castrate Resistant Prostate Cancer Therapeutics Market Analysis Executive Summary

South Africa Castrate Resistant Prostate Cancer Therapeutics Market valued at $66 Mn in 2022, projected to reach $126 Mn by 2030 with a 8.33% CAGR.

Castration-resistant prostate cancer (CRPC) occurs when prostate cancer continues to progress despite a significant decrease in testosterone levels achieved through treatments like surgical removal of the testicles or medication. The resistance is attributed to the cancer's ability to find alternative pathways for growth, often by utilizing residual testosterone or converting other hormones, such as adrenal steroids. The development of CRPC involves a complex interplay of genetic mutations within cancer cells and their surrounding microenvironment. These mutations can modify how cells respond to hormones, allowing them to thrive even in conditions of low testosterone. Although CRPC poses a substantial challenge, there are still available treatment options that generally fall into two main categories: targeting the androgen receptor pathway and directly treating the cancer itself. Androgen receptor-targeted therapies aim to hinder the cancer's ability to utilize any remaining testosterone or alternative hormones. Medications like enzalutamide and darolutamide belong to this category. Direct cancer treatment methods include chemotherapy, which uses drugs to eliminate rapidly dividing cancer cells, and radiotherapy, which employs targeted radiation to damage and reduce tumors. Emerging options like PARP inhibitors are also being explored, targeting specific vulnerabilities in the cancer's DNA repair mechanisms.

Prostate cancer is prevalent in South Africa, with a lifetime risk of one in every fifteen males. It accounts for around 13% of all male cancer fatalities in South Africa. In South Africa, around 20% of prostate cancer patients develop metastatic castrate-resistant prostate cancer (mCRPC) within five years after hormonal ablation therapy.

The key drivers of the market in South Africa include the increasing prevalence of prostate cancer, limited affordability and healthcare access creating an opportunity for generic drug manufacturers, and the combined effects of heightened awareness, improved diagnostics, and expanded treatment availability driving early detection and long-term management demand.

Pfizer, Johnson & Johnson, Bayer, and Roche are important worldwide companies; therefore, they are expected to have a significant presence in South Africa. Their recognized products, such as Xtandi, Zytiga, and Nubeeqa, are well-known and have established treatment regimens. Companies like Aspen provide more economical options, making them more appealing in cost-conscious regions.

Market Dynamics

Market Growth Drivers

Increasing Prevalence: The rising occurrence of prostate cancer, coupled with an aging population in South Africa, positions it as the most prevalent non-skin cancer among men. The incidence rates are expected to climb in tandem with the expanding and aging demographic, resulting in a larger potential patient base in need of therapies for castration-resistant prostate cancer (CRPC), thereby boosting market demand.

Limited Affordability and Healthcare Access: Inequities in affordability and healthcare access persist in South Africa, especially in rural areas, despite improvements in healthcare accessibility. The high cost of branded CRPC medications can be a barrier for many patients. This creates an opportunity for generic drug manufacturers to bridge the gap, potentially fostering growth in this market segment.

Increased Awareness and Treatment Availability: The combination of increased awareness about prostate cancer and CRPC, along with advancements in diagnostic methods and treatment availability, promotes early detection and intervention. This, in turn, expands the pool of patients requiring long-term management of CRPC, potentially driving demand for a variety of treatment options and contributing to market expansion.

Market Restraints

Economic Barriers and Affordability: One significant restraint for castrate-resistant prostate cancer therapeutics in South Africa is the economic constraint faced by many patients. The high cost of advanced CRPC treatments, especially branded medications, may make them unaffordable for a considerable portion of the population. This economic barrier limits access to effective therapies, hindering optimal treatment and outcomes for patients.

Healthcare Disparities and Access Challenges: South Africa experiences notable disparities in healthcare access, particularly between urban and rural areas. Limited access to specialized medical facilities and oncology expertise in certain regions impedes the timely diagnosis and administration of CRPC therapeutics. This healthcare divide contributes to delayed intervention and suboptimal management of castrate-resistant prostate cancer, impacting overall treatment effectiveness.

Limited Treatment Infrastructure: Another market restraint is the inadequacy of treatment infrastructure for advanced prostate cancer in some healthcare facilities. The absence of comprehensive cancer care centers and advanced treatment technologies in certain regions may limit the availability of cutting-edge therapies for castrate-resistant prostate cancer patients. This deficiency in treatment infrastructure poses a challenge to delivering optimal care and limits the range of therapeutic options accessible to patients in those areas.

Competitive Landscape

Key Players:

- Pfizer

- Johnson & Johnson

- Roche

- Bayer

- AstraZeneca

- Sanofi

- Aspen

- Novartis

- Cipla

- Dr Reddy’s

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Africa Castrate Resistant Prostate Cancer Therapeutics Market Segmentation

By Route

- Parenteral Route

- Oral Route

- Others

By Therapy

- Hormone Therapy

- Chemotherapy

- Immunotherapy

- Radiotherapy

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Academics & Research Centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.