Saudi Arabia Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Analysis

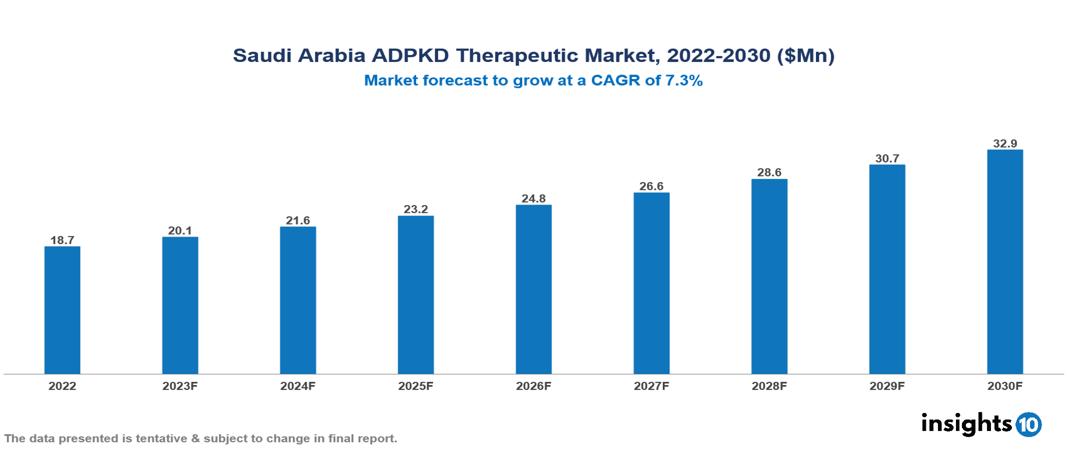

The Saudi Arabia Autosomal Dominant Polycystic Kidney Disease Therapeutics Market was valued at US $19 Mn in 2022, and is predicted to grow at a CAGR of 7.3% from 2023 to 2030, to US $33 Mn by 2030. The key drivers of this industry include the upward trend in the incidence of autosomal dominant polycystic kidney disease, increased awareness, and other factors. The industry is primarily dominated by players such as Otsuka, Sanofi, Pfizer, and Janssen Pharmaceutical, among others

Buy Now

Saudi Arabia Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Analysis

The Saudi Arabia Autosomal Dominant Polycystic Kidney Disease Therapeutics Market is at around US $19 Mn in 2022 and is projected to reach US $33 Mn in 2030, exhibiting a CAGR of 7.3% during the forecast period.

Autosomal dominant polycystic kidney disease ADPKD is caused by PKD1 and PKD2 gene mutations, which result in fluid-filled kidney cysts. In most cases, these cysts expand, resulting in renomegaly and eventual failure. Symptoms of ADPKD include pain, exhaustion, urinary tract infections, and more. Although there is no cure, several treatment modalities primarily focus on symptomatic management and limit disease progression. The only drug available is tolvaptan (Jinarc) manufactured by Otsuka Pharmaceuticals, which is known to be a vasopressin blocker and reduces cyst formation in some patients. Other therapy options include pain management and lifestyle modifications.

The incidence of ADPKD is around 1 in every 500 to 1 in every 1000 individuals in Saudi Arabia. Approximately 10% of these patients suffer from end-stage kidney disease (ESKD). The market is therefore driven by major factors like the increased incidence of ADPKD cases, government initiatives focusing on novel therapies, and increased awareness of the population. However, conditions such as high costs of treatments like gene therapy, regulatory challenges, and others hinder the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Surge in the incidence of ADPKD: Recent estimates have revealed that ADPKD is the most common inherited kidney disease, occurring at an incidence rate of 1 in every 500 to 1 in every 1000 individuals and detected in around 7% to 10% of those with End-Stage kidney disease (ESKD). These estimates are expected to show an upward trend and growth of the market.

Government initiatives: Government initiatives in Saudi Arabia have made ADPKD a priority issue and are focusing on investing for novel therapeutics development and research. The stable economic conditions of the country further allow the exploration of gene therapy and gene editing as potential options which results in market expansion.

Increased awareness: Groups such as the National Kidney Fund in Saudi Arabia actively push for research funding, enhanced healthcare access, and public awareness. Their activities stimulate market growth by encouraging early detection, initiating treatment, and bolstering disease management practices.

Technological advances: Telemedicine, remote monitoring, and AI-based digital healthcare innovations enhance access to specialized ADPKD care, ultimately improving patient outcomes and potentially fostering treatment adherence, thereby stimulating market expansion.

Market Restraints

Health System Challenges: Saudi Arabia's healthcare system is progressing, yet discrepancies in accessing specialized care and advanced treatments may persist between urban and rural regions. Relying on imported medications could face fluctuating expenses and potential disruptions in the supply chain and restricting the growth of the market.

Regulatory challenges: Although advancements in medication approval and market entry regulations are underway, manoeuvring through the system might be complex, potentially delaying the launch of innovative ADPKD treatments. Establishing a strong pharmacovigilance system to oversee the safety and effectiveness of ADPKD medications are lacking.

Healthcare Policies and Regulatory Landscape

Saudi Arabia's healthcare landscape is undergoing a major transformation spurred by Vision 2030. Regulatory bodies like the Ministry of Health, the Council of Cooperative Health Insurance, and the SACB are actively shaping the landscape, with significant changes already implemented, especially regarding mandatory health insurance for expats. These shifts present immense opportunities for pharmaceutical companies. Increased healthcare spending, infrastructure upgrades, and potential privatization are expected to further reshape the regulatory environment.

Navigating this dynamic landscape requires careful adherence to regulations. Obtaining licenses, particularly pharmacy licenses, now involves stricter procedures outlined by the Saudi Food and Drug Authority (SFDA). Staying informed about evolving regulations is crucial for pharma businesses to capitalize on the Saudi healthcare boom.

Competitive Landscape

Key Players

- Otsuka Pharmaceutical Co. Ltd

- Pfizer Inc

- Novartis

- Janssen Pharmaceuticals

- Sanofi

- Roche

- Bayer

- AbbVie Inc

- AstraZeneca

- Poxel

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Segmentation

By Treatment

- Pain & Inflammation Treatment

- Kidney Stone Treatment

- Urinary Tract Infection Treatment

- Kidney Failure Treatment

By Route of Administration

- Oral

- Parenteral

- Others

By End User

- Hospitals

- Speciality Clinics

- Surgical Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.