India Medical Digital Imaging System Market Analysis

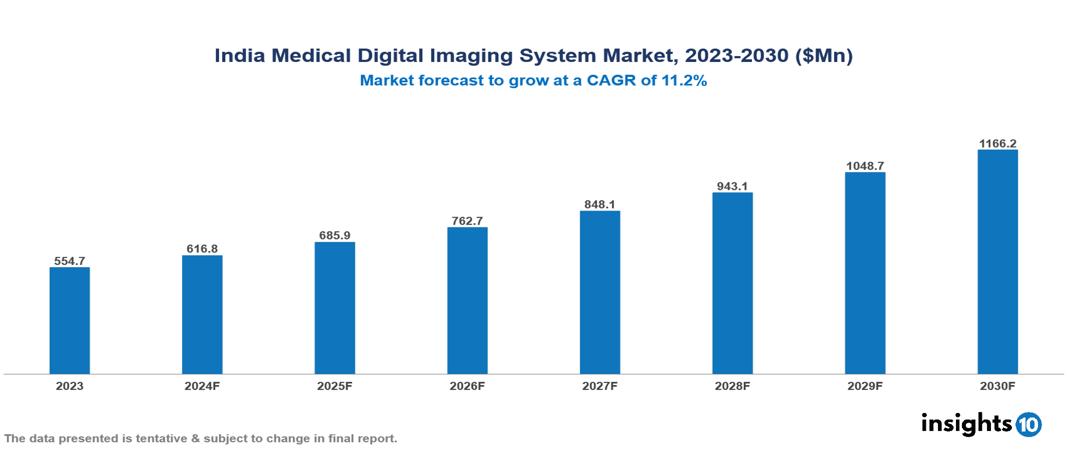

The India Medical Digital Imaging System Market was valued at $554.67 Mn in 2023 and is predicted to grow at a CAGR of 11.2% from 2023 to 2030, to $1166.19 Mn by 2030. The key drivers of this industry include medical tourism, the prevalence of chronic disease, and technological advancements. The industry is primarily dominated by players such as Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems Corporation among others.

Buy Now

India Medical Digital Imaging System Market Executive Summary

The India Medical Digital Imaging System Market was valued at $554.67 Mn in 2023 and is predicted to grow at a CAGR of 11.2% from 2023 to 2030, to $1166.19 Mn by 2030.

Medical digital imaging systems comprise various technologies employed in healthcare to create visual representations of the body's internal structures for clinical analysis and medical interventions. These systems have evolved considerably and are crucial in contemporary medicine, assisting in the diagnosis and treatment of diseases. Medical imaging encompasses ultrasound, x-rays, computed tomography (CT scans), Magnetic Resonance Imaging (MRI), and nuclear medicine technologies.

As of 2023, major private hospitals in India conducted an average of 120 radiology scans daily, facilitated by advanced diagnostic technologies. India has approximately 31 CT scanners per Mn population. The market is driven by significant factors like rising medical tourism, surge in the prevalence of chronic disease, and technological advancements. However, high costs, healthcare disparity, and, regulatory challenges restrict the growth and potential of the market.

Prominent players in this field include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems Corporation among others.

Market Dynamics

Market Growth Drivers

Rising Medical Tourism: The expected rise in medical tourists visiting India, forecasted to increase from approximately 6.1 Mn in 2023 to about 7.3 Mn in 2024, serves as a market driver for the medical digital imaging systems market in India. This influx enhances the demand for advanced diagnostic imaging technologies, as medical tourists seek high-quality healthcare services, including precise and efficient diagnostic procedures, thereby stimulating growth in the digital imaging sector.

Surge in the Prevalence of Chronic Disease: About 21% of India's elderly population aged 60 and above reportedly suffer from at least one chronic disease, with urban areas showing a higher prevalence at 29% compared to 17% in rural areas. This demographic and health profile underscores the significant demand for medical digital imaging systems in India. Advanced imaging technologies are crucial for early detection, precise diagnosis, and effective management of chronic diseases, driving market growth and adoption of digital imaging systems.

Technological Advancements: Ongoing advancements in digital imaging technology, such as enhanced resolution and integration with artificial intelligence, improve diagnostic precision and efficiency, fueling market expansion.

Market Restraints

High Cost: The high initial investment needed to purchase and install advanced imaging systems can act as a market restraint for the medical digital imaging systems market in India. This financial barrier particularly affects smaller healthcare facilities, limiting their ability to adopt and integrate these technologies, thereby slowing down market growth and accessibility across the country.

Healthcare Disparity: The unequal distribution of healthcare infrastructure between urban and rural areas in India restricts access to advanced imaging technologies in remote regions, which impedes the penetration of the medical digital imaging systems market. This disparity hinders widespread adoption and utilization of these technologies across the country, thereby limiting their impact on improving healthcare outcomes in underserved areas.

Regulatory Challenges: Stringent regulatory requirements and lengthy approval processes for new technologies can slow down their introduction and adoption in the medical digital imaging systems market in India. This restraint creates delays in bringing innovative imaging technologies to market, thereby hindering healthcare providers' ability to upgrade and integrate advanced imaging solutions efficiently.

Regulatory Landscape and Reimbursement Scenario

Medical devices, including digital imaging systems, fall under the regulation of the Drugs and Cosmetics Act, 1940, and the Medical Device Rules, 2017 in India. Only notified medical devices are regulated under these laws, and digital imaging systems are classified as notified medical devices. Manufacturers and suppliers of these devices must obtain licenses and registrations from either the Central Licensing Authority (CLA) or the State Licensing Authority (SLA). On the reimbursement side, the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY), a government-sponsored health insurance program, aims to provide coverage to low-income families. However, the current reimbursement framework does not fully address the needs of radiologists and medical imaging providers despite expanding access to imaging services.

Competitive Landscape

Key Players

Here are some of the major key players in the India Medical Digital Imaging System Market:

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Canon Medical Systems Corporation

- Fujifilm

- Carestream Health Inc.

- Samsung Medison

- Esaote

- Shimadzu

- Mindray Medical International

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Medical Digital Imaging System Market Segmentation

By Type

- X-Ray

- MRI

- CT scan

- Ultrasound

- Others

By Technology

- 2D Imaging System

- 3D/4D Imaging System

By Application

- Orthopedics

- Oncology

- Cardiology

- Neurology

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.