China Healthcare Insurance Market Analysis

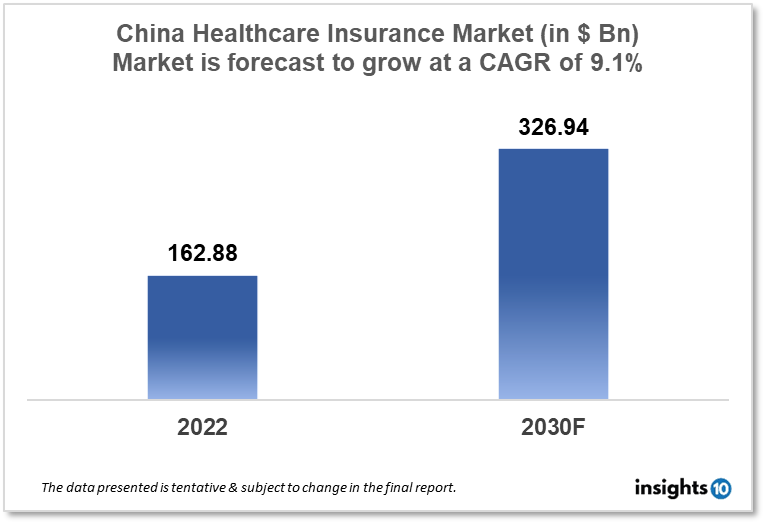

The China healthcare insurance market is projected to grow from $162.88 Bn in 2022 to $326.94 Bn by 2030, registering a CAGR of 9.1% during the forecast period of 2022 - 2030. The main factors driving the growth would be increasing health insurance premiums, growing awareness of health risks and rising medical costs. The market is segmented by component, the provider, coverage, health insurance plans and end-user. Some major players include Ping and Insurance, China Life Insurance, People’s Insurance, China Pacific Insurance and New China Life Insurance.

Buy Now

China Healthcare Insurance Market Executive Summary

The China healthcare insurance market is projected to grow from $162.88 Bn in 2022 to $326.94 Bn by 2030, registering a CAGR of 9.1% during the forecast period of 2022 - 2030. From 5.17% of GDP in 2018 to 5.35% of GDP in 2019, China spent more on health. The cost of healthcare as a proportion of GDP is still lower in underdeveloped nations, where it typically ranges around 10%.

In China, there are three types of medical insurance: basic coverage for workers at urban businesses, basic coverage for other city dwellers, and rural cooperative medical insurance for the farming community. In China, basic medical insurance for urban employees is a requirement, and both the employee and the employer are responsible for covering the costs. Although the contributions to it vary from municipality to municipality, they typically amount to 6% of the employer's wage costs and 2% of the employee's salary. The self-employed are also eligible for this insurance but must pay full premiums. Health insurance for non-enterprise inhabitants is funded by the state and the individual. Insurance is financed by the state for those who are unemployed or receiving social assistance.

At the moment, the landscape of the private health insurance market is relatively narrow. The most common types of healthcare plans are life insurance policies, that pay out a lump sum for any critical illness a person is diagnosed with.

Market Dynamics

Market Growth Drivers

The China Healthcare Insurance market is expected to be driven by factors such as:

- Increasing health insurance premiums- China's health insurance premiums hit $143 Bn in 2021, according to China Business News and Ping An Health Insurance. As a result, China's health insurance rates are the most obvious on the market for health insurance, and their share has grown annually. Thus, the health insurance sector in China will grow

- Growing awareness of health risks- A rise in the prevalence of chronic diseases including cancer, disease, and diabetes as well as an increase in the number of traffic accidents are all results of unhealthy lifestyle choices. Also, as people become more conscious of health risks, insurance companies have opportunities to grow, particularly in the wake of Covid-19. Given China's growing ageing population and rising economic levels, the country's health system has assumed greater significance. With an increase in income, people are more likely to spend money on healthcare-related items

- Rising medical costs- The primary causes of the need for health insurance are escalating medical expenses and exorbitant childcare treatment costs, particularly in private hospitals. The region is currently experiencing a new financial plague due to rising hospital and surgical service costs. If a person does not receive benefits, the cost of hospital care alone could entirely deplete any savings they may have. As a result, the rising cost of medical services has forced people to get health insurance in order to improve insurance coverage and support the market for health insurance. Private insurance has therefore become more important in recent years for China's health insurance business

Market Restraints

The following factors are expected to limit the growth of the healthcare insurance market in China:

- Limited Coverage- In China, the market for health insurance is still developing, and it offers only a limited range of protection, particularly for residents of rural areas

- High out-of-pocket expenses- Even those with health insurance may incur high out-of-pocket costs. This is due to the fact that insurance frequently only pays a fraction of medical expenses, leaving patients to bear the balance

- Ageing population- The healthcare insurance sector in China faces a substantial problem as a result of China's ageing population. When people get older, they need more medical attention, which strains the healthcare system and drives up insurance costs

Competitive Landscape

Key Players

- Ping and Insurance (CHN)- China's Ping An was established in 1988. The company started out as a property and casualty insurance provider but has subsequently grown into the banking, wealth management, life insurance, and online financial services industries with the stated objective of becoming a full-service provider of financial services. Ping An is not only the largest insurance provider in China but also one of the best insurance providers worldwide

- China Life Insurance (CHN)- The second-largest corporation in China in terms of net non-banking assets and net premiums written for 2020 is China Life Insurance. The establishment of the People's Republic of China in 1949 is where China Life got its start. It runs businesses in the fields of life insurance, property and casualty insurance, asset management, and other financial services

- People’s Insurance (CHN)- In 1949, the People's Insurance Company of China Group was founded. The group's primary business activities include property insurance, reinsurance, health insurance, life insurance, pension insurance, commercial property, agricultural policies, and operational insurance, in addition to those of its subsidiaries

- China Pacific Insurance (CHN)- Providing life, property, and reinsurance products as well as asset management and financial services, China Pacific Insurance Group is an integrated insurance company

- New China Life Insurance (CHN)- The insurance company New China Life Insurance Co., Ltd. provides services and products for health, accident, and life insurance. The segments it operates via include Individual Insurance, Group Insurance, and Others. Sales of investment and insurance contracts to people are included in the Individual Insurance segment. Selling insurance and investment contracts to group entities is what the group insurance segment does. The Other division manages assets and handles the group's unallocated income and expenses

Notable Deals

March 2020- Ping An Insurance Company and Shionogi came to a basic agreement about a financial and commercial alliance in order to develop a long-term strategic partnership. Through this collaboration, Shionogi's expertise in therapeutic discovery and development will be combined with Ping An's cutting-edge technology to produce a holistic platform for healthcare innovation and delivery.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Healthcare Insurance Market Segmentation

By Provider (Revenue, USD Billion):

It mainly includes healthcare insurance that provides safety against the increasing cost of medical treatments and in case of health emergencies such as critical illnesses. Hence, it is the best way to safeguard medical expenses.

- Public

- Private

By Coverage Type (Revenue, USD Billion):

In terms of sales and market share, it is anticipated to rule the market over the projection period. This is explained by a number of benefits provided by life insurance, including guaranteed death payout and permanent coverage. Additionally, investing in these kinds of plans enables working professionals to save taxes

- Life Insurance

- Term Insurance

By Health Insurance Plans (Revenue, USD Billion):

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High Deductible Health Plan (HDHP)

By Demographics (Revenue, USD Billion):

- Minors

- Adults

- Seniors

There is a high prevalence of lifestyle disease in the adult population that can increase health risks in the future. The population is more prone to cardiac and other diseases that require hospitalization. Healthcare insurance plans for seniors are more of a necessity, especially in the case of retirement. Also, it carries various advantages such as no medical screening before buying plans, includes coverage of the outpatient department, and provides the benefit of fee annual checkups along with lifetime renewability.

By End-user (Revenue, USD Billion):

- Individuals

- ?Corporates

A large number of people buy individual health plans as they are also customizable. Also, it gives more control over deductibles, co-pays, and benefits limits and is not dependent on employment status.

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.