Canada Central Nervous System (CNS) Therapeutics Market Analysis

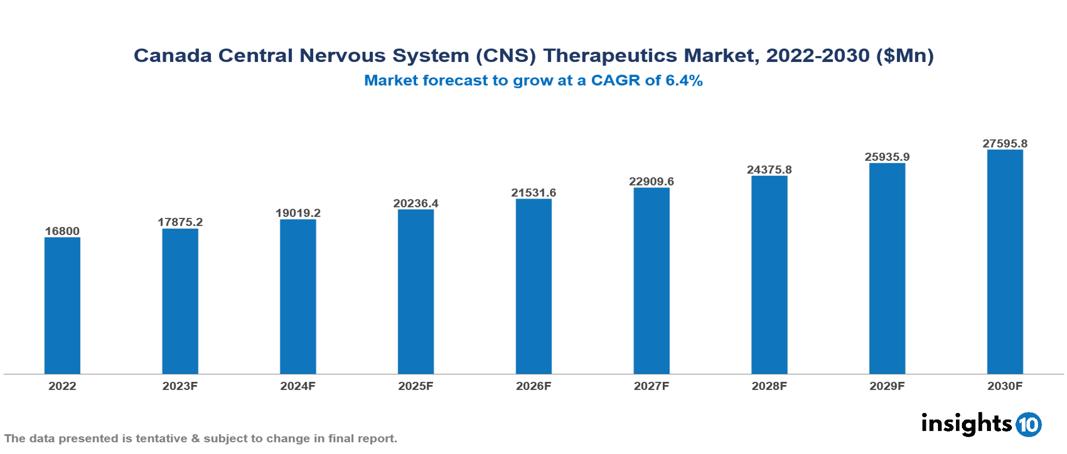

The Canada Central Nervous System (CNS)Therapeutics Market was valued at US $16.8 Bn in 2022 and is predicted to grow at a CAGR of 6.4% from 2023 to 2030, to US $27.596 Bn by 2030. The key drivers of this industry include the upward trend in the prevalence of CNS diseases, supportive government initiatives, and technological factors. The industry is primarily dominated by players such as Pfizer, Novartis, Teva Pharmaceutical, Otsuka, AbbVie, Roche, and Eli Lilly among others.

Buy Now

Canada Central Nervous System (CNS) Therapeutics Market Executive Summary

The Canada Central Nervous System (CNS)Therapeutics Market is at around US $16.8 Bn in 2022 and is projected to reach US $27.596 Bn in 2030, exhibiting a CAGR of 6.4% during the forecast period.

Central Nervous System (CNS) diseases encompass a wide range of medical conditions that affect the brain and spinal cord, interfering with the central nervous system's normal function. These disorders are classified into several categories, including neurodegenerative diseases like Alzheimer's and Parkinson's, psychological conditions like depression and schizophrenia, and neurological disorders like epilepsy and multiple sclerosis. Causes of CNS disorders can be diverse, ranging from genetic factors and environmental influences to infections, injuries, or autoimmune responses. Symptoms vary depending on the disorder, but they frequently include changes in cognitive function, motor skills, mood, or sensory perception. Current treatments for CNS conditions are intended to alleviate symptoms, reduce disease progression, or control complications. Medication, psychotherapy, and, in certain situations, surgery are all options for treatment. Pharmaceutical companies actively involved in producing medications for CNS disorders include giants like Pfizer, Eli Lilly, and Johnson & Johnson. For instance, Pfizer manufactures medications for Alzheimer's disease, while Eli Lilly is known for its contributions to psychiatric medications.

The estimated prevalence of CND disorders poses a significant public health burden affecting around 10% of the population in Canada. The market therefore is driven by major factors like increased prevalence of CNS disorders, supportive government policies, and technological advancements in the industry. However, conditions such as high costs of treatment, several regulatory challenges, and limited reimbursement in Canada and others hinder the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Surge in the prevalence of CNS diseases: Canada is facing a public health burden posed by neurodegenerative conditions such as Alzheimer's and Parkinson's. The estimated prevalence of neurological diseases is about 10% affecting around 3.6 Mn people. The Alzheimer Society of Canada projects that nearly half a Mn Canadians currently contend with dementia, with an anticipated surge in numbers as the population ages. Additionally, mental health disorders like depression, anxiety, and ADHD are widespread in Canada, impacting the Mns of adults and children. This rising demand for treatment avenues is expected to propel market expansion

Supportive government initiatives: The Canadian government is actively engaged in promoting research and development in the field of CNS diseases. This commitment is evident through initiatives such as the Canadian Brain Research Fund and the Dementia Strategy. Public awareness campaigns are playing a crucial role in elevating consciousness about CNS disorders, advocating for early diagnosis and prompt treatment-seeking, which, in turn, contributes to an increased demand in the market. The increased funding and heightened awareness result in expanded resources for research and development, creating opportunities for breakthroughs and innovative treatments that have the potential to further drive market growth.

Technological advancements: Customizing CNS treatment techniques based on individual genetic and biological factors can improve therapeutic effectiveness and precision. Advances in drug delivery technologies, especially nanomedicine, aim to improve the efficacy of CNS medications while minimizing adverse effects. This developing field has the potential to change the therapeutic environment and drive market growth.

Market Restraints

Limited reimbursement: In Canada's single-payer system, the emphasis on cost-effectiveness poses a hurdle for the public reimbursement of novel and costly CNS drugs, potentially restricting patient access to cutting-edge treatments. Despite the presence of public insurance, individuals may encounter substantial out-of-pocket expenses for specific CNS medications, creating obstacles to affordability and impeding adherence to prescribed treatment regimens.

High costs of treatment: The intricate process of development and strict regulatory requirements result in elevated production expenses for numerous Central Nervous System (CNS) therapeutics. This heightened cost factor renders these treatments financially out of reach for certain patients and places a burden on healthcare budgets, constraining access for patients and impeding market expansion.

Regulatory challenges: Health Canada, the regulatory authority, imposes stringent criteria for ensuring the safety and effectiveness of drugs. This results in extended development timelines and elevated expenses in comparison to alternative markets. Canada encounters obstacles with a limited number of clinical trial sites and struggles to recruit diverse patient populations, contributing to prolonged development periods and heightened costs. Given the intricate nature of Central Nervous System (CNS) drug development, there is a substantial risk of failure, prompting companies to exhibit reluctance in making substantial investments exclusively in the Canadian market.

Notable Updates

January 2024, Lipocine Inc., a biopharmaceutical company specializing in the treatment of Central Nervous System (CNS) disorders, has teamed up with Gordon Silver Limited and Verity Pharmaceuticals, Inc. (Verity Pharma) to establish an exclusive licensing agreement. According to the agreement, Verity Pharma will take on the marketing responsibilities for TLANDO® in Canada.

Healthcare Policies and Regulatory Landscape

In Canada, the main regulatory authority for therapeutics is Health Canada. Specifically, the regulation of pharmaceuticals, biologics, and medical devices falls under the jurisdiction of the Health Products and Food Branch (HPFB). Health Canada ensures that therapeutic products available in the Canadian market meet stringent standards for safety, efficacy, and quality.

To obtain licensure for therapeutics in Canada, companies typically follow a stepwise process. This involves submitting a New Drug Submission (NDS) or a Biologics License Application (BLA) that includes comprehensive data on the product's safety and efficacy. If the product meets the regulatory standards, Health Canada grants a Notice of Compliance (NOC), allowing the therapeutic to be marketed and sold in Canada.

For new entrants, the regulatory environment can be demanding due to the thorough evaluation processes. However, Health Canada provides clear guidelines, and collaboration with the regulatory authority is essential for navigating the regulatory landscape and gaining approval for new therapeutic products.

Competitive Landscape

Key Players

- Pfizer Inc.

- AbbVie

- Johnson & Johnson

- Novartis AG

- F. Hoffman-La Roche Ltd

- Lundbeck

- Otsuka Pharmaceutical

- Biogen

- Teva Pharmaceutical

- Eli Lilly

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Canada Central Nervous System (CNS)Therapeutics Market Segmentation

By Drug

- Biologics

- Non-Biologics

By Drug Class

- Antidepressants

- Analgesics

- Immunomodulators

- Interferons

- Decarboxylase Inhibitors

- Others

By Disease

- Neurovascular Disease

- Degenerative Disease

- Infectious Disease

- Mental Health

- CNS Cancer

- Others

By Distribution Channel

- Hospital based pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.