Australia Home Healthcare Market Analysis

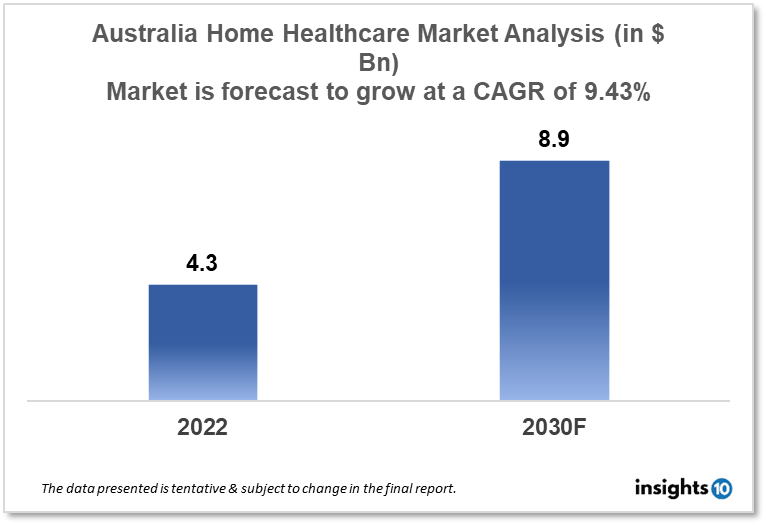

Australia's home healthcare market is projected to grow from $4.3 Bn in 2022 to $8.9 Bn by 2030, registering a CAGR of 9.43% during the forecast period of 2022-30. Because of the rising older population and the increasing number of people motivated to fight ailments including heart problems, diabetes, and various respiratory illnesses, the Australia home healthcare market is expanding at a promising CAGR. The market is segmented by solution, by deployment, and by end-use. There are a number of private companies that provide home healthcare services in Australia, including Bupa, NIB Health Funds, and HCF.

Buy Now

Australia Home Healthcare Market Executive Summary

Australia's home healthcare market is projected to grow from $4.3 Bn in 2022 to $8.9 Bn by 2030, registering a CAGR of 9.43% during the forecast period of 2022-30.

Australia is a developed, rich nation with a robust economy that is widely diversified. It is the sixth-biggest economy in the Asia-Pacific region and the 13th-largest economy overall. Many industries, including mining, agriculture, manufacturing, and services, are the main drivers of the Australian economy. Australia's gross domestic product (GDP) was about $1.725 trillion as of 2022. In 2019–2020, Australia is expected to spend $202.5 billion on health-related goods and services, or $7,926 per person.

Australia is a substantial producer of agricultural goods like wheat, sugar, and dairy products as well as a major exporter of natural resources like coal, iron ore, and natural gas. While the services sector is the largest contributor to the economy, accounting for over 70% of GDP, the manufacturing sector is varied in the nation with a focus on high-tech and sophisticated manufacturing.

Since more people choose to get medical treatment and support in the convenience of their own homes, the home healthcare market in Australia is expanding as a part of the healthcare sector. The aging of the population, improvements in medical technology that enable more types of treatment to be provided at home, and the desire of many patients to avoid hospital stays and get care in a more familiar and comfortable environment are some of the causes driving this trend.

In Australia, home healthcare services are typically provided by a range of providers, including government agencies, non-profit organizations, and private companies. These services may include nursing care, physiotherapy, occupational therapy, speech therapy, and other types of medical and support services.

Market Dynamics

Market Growth Drivers and Restraints

Because of the rising older population and the increasing number of people motivated to fight ailments including heart problems, diabetes, and various respiratory illnesses, the Australia home healthcare market is expanding at a promising CAGR. Additionally, home healthcare equipment in Asia-Pacific is still in its infancy. These factors have been propelling home healthcare technology during the review period and will continue to do so. The Australia home healthcare market's growth would be restricted, nonetheless, by the high price in addition to the problems with payback associated with the choice of home healthcare devices. In addition, rising healthcare costs across the board are a significant driver of the Asia Pacific home healthcare market's expansion.

Competitive Landscape

Key Players

There are a number of key players in the home healthcare market in Australia, including:

Government agencies: The federal and state governments in Australia provide a range of home healthcare services through public hospitals and community health centers. These services may include nursing care, physiotherapy, occupational therapy, and other types of medical and support services.

Non-profit organizations: There are also a number of non-profit organizations that provide home healthcare services in Australia, such as the Red Cross, Meals on Wheels, and Silver Chain Group. These organizations often rely on donations and government funding to support their services.

Private companies: There are also a number of private companies that provide home healthcare services in Australia, including

- Bupa,

- Medibank Private

- Australian Unity

- Allianz

- NIB Health Funds

- HCF

These companies offer a range of services, including nursing care, physiotherapy, and occupational therapy, and may also offer home modification services and assistive technology to help people live independently at home.

Individual caregivers: Many people in Australia also receive home healthcare services from individual caregivers, such as family members or private contractors. These caregivers may provide a range of services, including personal care, nursing, and home maintenance.

Healthcare Policies and Regulatory Landscape

According to the Therapeutic Goods Act 1989 (Cth) and its delegated legislation, the Therapeutic Goods Administration (TGA), the Commonwealth regulator, is responsible for overseeing the regulation of therapeutic goods in Australia, including prescription drugs, over-the-counter drugs, complementary medicines, medical devices, and certain blood and blood products. The TGA is in charge of examining, judging, and keeping track of products that are produced or supplied in, exported from, or imported into Australia.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Australia Home Healthcare Market Segmentation

By Device Type (Revenue, USD Billion):

Based on the Device Type the market is segmented into Testing, Screening, Monitoring Devices, Therapeutic Home Healthcare Devices, and Mobility Assist.

- Testing, Screening, and Monitoring Device

- Blood Glucose Monitors

- Blood Glucose Monitors

- Blood Pressure Monitors

- Heart Rate Monitors

- Temperature Monitors

- Sleep Apnea Monitors

- Coagulation Monitors

- Ovulation and Pregnancy Test Kits

- Pulse Oximeters

- Home Hemoglobin A1C Test Kit

- Therapeutic Home Healthcare Devices

- Oxygen Delivery Systems

- Nebulizers

- Ventilators

- Sleep Apnea Therapeutic Devices

- Wound Care Products

- IV Equipment

- Dialysis Equipment

- Insulin Delivery Devices

- Inhalers

- ?Other Therapeutic Products (ostomy devices, automated external defibrillators (AEDs)

- Mobility Assist

- Walkers and Rollators

- Wheelchairs

- Canes

- Crutches

- ?Mobility Scooters

By Service Type (Revenue, USD Billion):

- Skilled Nursing Services

- Rehabilitation Therapy Services

- Hospice and Palliative Care Services

- Unskilled Care Services

- Respiratory Therapy Services

- Infusion Therapy Services

- Pregnancy Care Services?

By Indication Type (Revenue, USD Billion):

- Cardiovascular Disorders & Hypertension

- Diabetes

- Respiratory Diseases

- Pregnancy

- Mobility Disorders

- Hearing Disorders

- Cancer

- Wound Care

- Other Indications (sleep disorders, kidney disorders, neurovascular diseases, and HIV)

Insights10 will provide you with the reports within 10 key parameters which are:

- Market Overview

- Market Growth Drivers & Restraints

- Epidemiology of Disease Type

- Market Segmentation

- Market Share

- Competitive Landscape

- Key Company Profiles

- Healthcare Policies & Regulatory Framework

- Reimbursement Scenario

- Factors Driving Future Growth

Based on our many years of experience, we believe that these are the parameters that are critical to decision-making for business stakeholders. Our focused approach to developing reports focused on 10 key parameters, enabled us to arrive at the name “Insights10”.

Stage I: Market Data Collection

Primary Interviews: We have developed a network of experts, freelancers, and researchers across countries through which we engage with local experts to gather key data points and assumptions about each market. We also engage regularly with some of the best market research agencies such as Atheneum, GuidePoint, GLG, etc. to conduct surveys and interviews, and build intelligence. We have language translators as a part of our team, who between them can cover 30+ languages allowing us to extract better local insights.

Secondary Data Collection: We have developed strong expertise and experience in secondary data collection methods for developing unique data sets and research material. We gather data from multiple reliable sources to maintain a high level of accuracy and consistency. The market data is analyzed and forecasted using appropriate statistical and coherent models. The report offers an overall analysis of the market size, growth, and market share as well as a segment-level analysis of the specific market. Our report includes precise, to-the-point information related to the overall market, competition, growth drivers, challenges, regulatory updates, and competition.

Data Sources: We have access to multiple highly reliable free and subscription data sources. We have many years of experience to understand which sources are more dependable for what and which to prefer for the reliable and latest information. The key sources of information include the following, but are not limited to:

Stage II: Market Data Analysis and Statistical Model

Market Trends: We generally look at macro parameters and micro indicators. The macro parameters include changes in government policies, demand and supply of the market, government intervention programs, and major market share. The micro indicators are GDP growth, market size, market volume, etc. We also understand nuances specific to each country like the US, Canada, India, Germany, etc., and have worked across 60+ countries and hence not only understand global trends but how these differ by country, how payment models, market structure, cultural parameters, etc. differ in each country.

Market Sizing and Analysis: Our expert data analytics team has created various market forecast models by employing the top-down approach i.e. starting with the large overall market and segmenting different areas and the bottom-up approach i.e. starting with population and epidemiology and rolling up based on spend, etc., estimating the size of the market, and distributing among the geographic and/or product segments.

The top-down approach is mainly used for new product forecasting and the bottom-up approach is used for demand estimation of any product for different countries summed up to form the total market. We are able to round off insights and build stronger forecasts because we always do both these methods and triangulate the final numbers.

The study on the market covers the analysis of the leading geographies such as Asia-Pacific, Africa, Europe, Middle East, North America, and Latin America for the period of 2022 to 2030. The qualitative analysis covers the industry landscape and trends, market opportunities, competitive landscape, and policy and regulatory scenario, and the quantitative analysis covers different market estimates and forecasts.

Data Triangulation & Validation:

Data triangulation of various sources and results of the research are carried out by benchmarking with reliable sources such as industry statistics, statistical databases, and company-level averages, etc.

We make sure to finalize the numbers in alignment with the market research. Firstly, our internal experts ensure thorough validation and checking to ensure accurate and precise analysis and then validation is also done using a multiple-data analysis model. Two-level validation is done and entails the finalization of the report scope and the way of representation pattern.

(1).png)

Stage III: Interpretation and Presentation

Analysis & Interpretation: The information gathered is then analyzed and synthesized. The second series of interviews are done if necessary to check and validate. The future opportunities are analyzed by understanding product commercialization and many other factors. It also comprises the analysis of data discrepancies observed across various data sources. Information procured from secondary and primary results is then, interpreted by considering the following parameters: (a partial list)

- Establishing market drivers and trends

- Analyzing the regulatory landscape to understand future growth

- Market Segment based analysis to obtain revenue/volume

- Analyzing current needs and determining penetration to estimate the market

Insights: Our reports deliver actionable insights backed with supporting facts and figures to assist you in achieving exemplary growth. Our in-depth analyses are interspersed with relevant insights and statistics to offer an executive-level view of a given market. The description helps in correlating many minor factors affecting the market and their impact on the different segments within the market.

Data curated from the analysis and interpretation are drawn to portray all in one consolidated report.

Presentation & Reporting: The market research report is presented in different forms such as charts by using a scientific approach for easy understanding. Historic, current, and future analysis is provided for each market in terms of both value and volume. The size of the market is interpreted in the US Dollar value and the respective unit, based on the product, for volume consumption.

The foreign exchange rates are calculated on the respective dates and for the respective regions covered in the study.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

This report addresses

- Intelligent insights to take informed business decisions

- Qualitative, acute and result oriented market analysis

- Market size and forecasts from 2022 to 2030

- Opportunities for expansion and in-depth market analysis

- Segmentation and regional revenue forecasts

- Analysis of the market share and competitive landscape

- Strategic Recommendations to chart future course of action

- Comprehensive Market Research Report in PDF and PPT formats

Need more?

- Ask our analyst how this study was put together to learn more

- Discuss additional requirements as part of the free customisation

- Add more countries or regions to the scope

- Get answers to specific business questions

- Develop the business case to launch the product

- Find out how this report may influence your business revenue